Struggling to get a mortgage because you’re self-employed or your income’s unpredictable? If you’re wondering how to get a DSCR loan, here’s a simple path to follow. These loans let your rental’s income do the talking—no W-2s needed. For background, see our DSCR loan explained guide.

Quick eligibility snapshot: Many lenders look for a DSCR of 1.2+, 20–25% down (or max 75–80% LTV), ~680+ credit for best pricing, and a few months of reserves.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- What is a DSCR Loan?

- Calculator: Check Eligibility

- Why Choose a DSCR Loan (and Where They Fit)

- Risks of DSCR Loans

- How to Get a DSCR Loan

- Common Mistakes to Avoid

- Alternatives to DSCR Financing

- Key Takeaways

- FAQs

- Conclusion

What is a DSCR Loan?

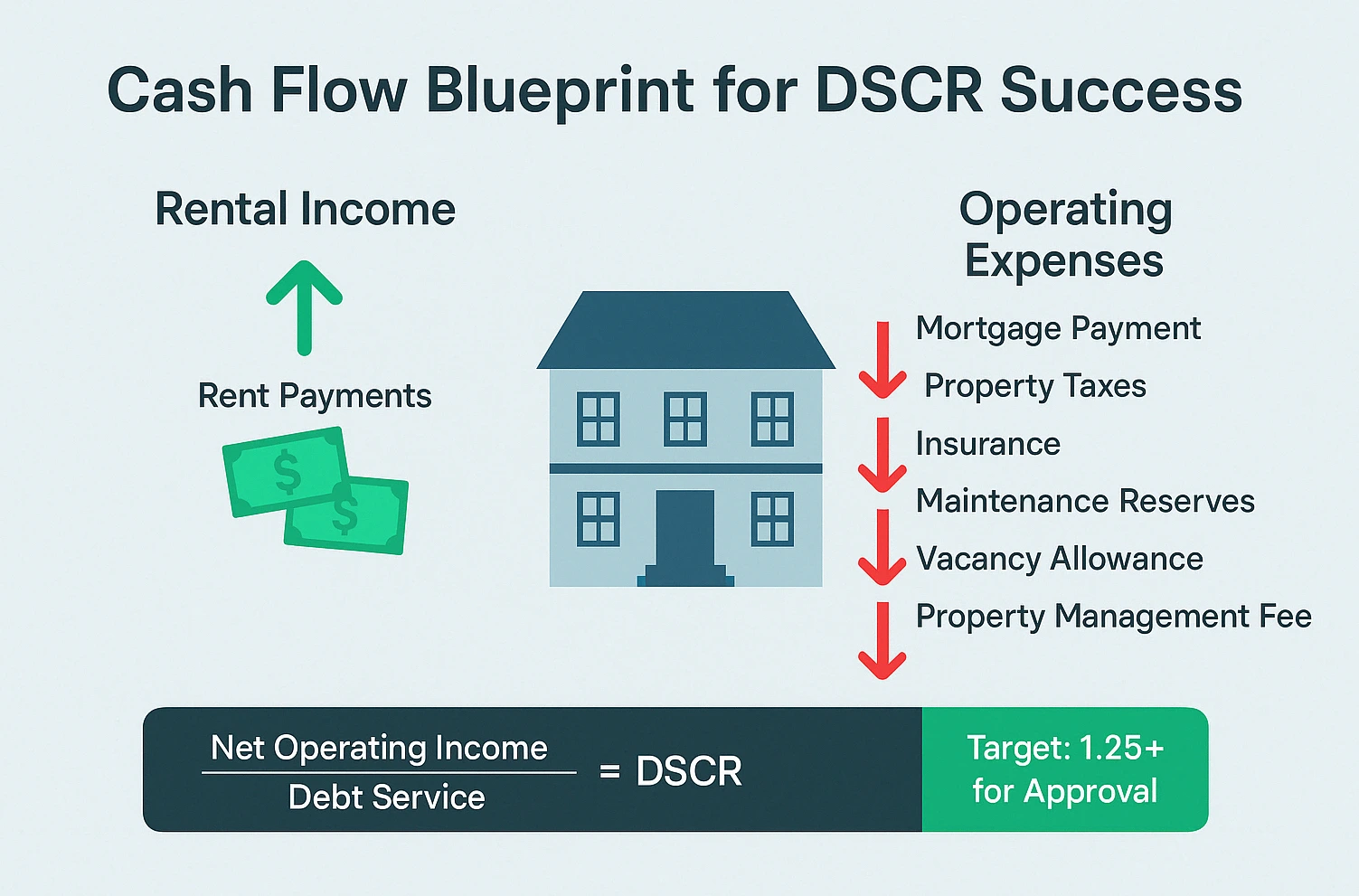

Debt service coverage ratio (DSCR) loans focus on your property’s income, not your personal finances. Lenders care about whether your rental can cover its bills more than your tax returns. For additional insights, see Investopedia’s DSCR overview.

Here’s the breakdown:

- Net Operating Income (NOI): Annual rent minus expenses like taxes, insurance, and maintenance.

- Debt Service: Total yearly payments for principal, interest, taxes, and insurance (PITI).

- DSCR Formula: NOI ÷ debt service. A DSCR of 1.2 or higher is a safer bet for lenders.

DSCR = Net Operating Income (NOI) / Total Debt Service

Example: $36,000 rent – $12,000 expenses = $24,000 NOI; $18,000 debt → DSCR 1.33.

Who Is This Guide For?

- Self-employed investors who hit income-verification roadblocks.

- Landlords growing rental portfolios with DSCR loans.

- Anyone learning the best way to qualify despite complex income.

DSCR Calculator: Check Your Property’s Eligibility

Try the sliders on mobile or type exact numbers. Your DSCR updates automatically. Results are estimates only; underwriting varies.

Why Choose a DSCR Loan (and Where They Fit)

DSCR loans are built for investors: they skip messy income verification in favor of the property’s numbers, can close faster than traditional mortgages, and scale as rent supports it.

- Property-first underwriting: Approval leans on NOI and DSCR, not W-2s.

- Speed & flexibility: Streamlined docs and options like interest-only periods.

- Portfolio growth: Easier to repeat when the cash flow pencils.

- Negotiation leverage: Strong DSCR can improve pricing and fees.

Risks of DSCR Loans

Rates & fees: DSCR loans may price 1–2% above comparable conforming mortgages and can include points and step-down prepayment penalties.

Income & property risk: Vacancies, turnover, and repairs can erode NOI; some properties may not meet program standards.

Structure & leverage: Balloon features, interest-only periods, and aggressive LTVs amplify risk if rents dip or expenses creep.

Stress test your deal. Before you lock a rate, rerun the math with a 10% rent drop and a 10% expense increase. If your DSCR is 1.25 today, a modest shift can push it to ~1.05—serviceable but thin. If it dips below 1.0, you’re feeding the property from your pocket. Mitigate by increasing the down payment, requesting an interest-only period (if it fits the plan), or choosing a submarket with stronger rent growth. A modest rate buydown can also help if pricing makes sense.

How to Get a DSCR Loan

Timeline: With documents ready, many DSCR loans close in 2–4 weeks. Fastest approvals come when rent comps, leases, insurance quotes, and entity docs (if using an LLC) are in hand.

1) Assess Your Financial Foundation

Know your net worth, monthly cash flow, credit profile (680+ helps pricing), and risk tolerance. Try our mortgage calculator to sanity-check payments (note: not a DSCR calc).

2) Hunt for High-Potential Properties

Prioritize reliable rent, realistic expenses, and solid locations. Include a vacancy buffer (e.g., 5–10%). Professional inspections prevent NOI surprises.

Example: Duplex at $1,500 per unit → $36,000 rent; $12,000 expenses → NOI $24,000; $18,000 debt → DSCR 1.33.

3) Master the DSCR Calculation

- Estimate income from real comps (not optimism).

- List recurring expenses: taxes, insurance, maintenance, management, utilities.

- NOI ÷ annual debt service = DSCR (aim ≥ 1.20).

4) Shop for the Best Loan Terms

Lenders price deals differently. A 0.5% rate gap on a $300,000 loan can add up to about $15,000 over 10 years—an illustrative estimate. See our guide to DSCR lenders for pricing tips.

| Item | What to Compare |

|---|---|

| Interest Rate & Type | Fixed vs. ARM; rate lock length |

| Points & Fees | Origination, underwriting, appraisal, third-party |

| Prepayment | Step-down schedule (e.g., 3-2-1), buy-out options |

| Interest-Only Years | IO period and re-cast details |

| DSCR Floor | Minimum DSCR used for pricing/approval |

| LTV / CLTV | Maximum leverage allowed |

| Recourse | Full, limited, or non-recourse carve-outs |

5) Build a Financial Safety Net

Hold 3–6 months of expenses, budget 1–2% of value for annual repairs, and carry landlord coverage. Screen tenants thoroughly.

6) Optimize Cash Flow Management

Run your rental like a small business. Track cash in and out, make rent collection effortless, tighten turnarounds, and re-shop vendors yearly.

7) Monitor Your DSCR Regularly

Check DSCR quarterly. Spot income dips early, review expenses for creep, adjust rents with the market, and consider refinancing if terms improve.

8) Prepare Your Documents (Checklist)

You’ll move faster—and meet typical DSCR loan requirements—when you have these on hand:

- Entity docs (LLC articles & operating agreement) or personal ID

- Lease/rent roll and market rent comps (1007 where applicable)

- Insurance quote and last property tax bill

- Bank statements showing reserves (often 3–6 months)

- HOA documents (if applicable) and appraisal access contact

What underwriters actually look at. Beyond a neat checklist, underwriters sanity-check the rent roll (realistic?), the 1007 or market rent comps, and the insurance quote (adequate coverage, correct occupancy). They’ll verify reserves, review entity docs if borrowing in an LLC, and consider any HOA rules that affect rentals. For short-term rentals, expect extra scrutiny—like seasonality and local STR ordinances. Pro tip: add a one-page summary of NOI, DSCR, LTV, reserves, and your exit plan with sources. Clean packages move faster.

Common Mistakes to Avoid

- Overestimating rent / underestimating expenses: Use comps; add a vacancy buffer.

- Accepting the first offer: Shop multiple DSCR lenders.

- Ignoring prepayment terms: Step-downs matter if exiting early.

- Overleveraging with no reserves: Keep cash for surprises.

- Skipping inspections: Hidden repairs crush NOI.

- Poor tenant screening: Avoid chronic non-payment and damage.

- Not monitoring DSCR: Fix slippage early.

Alternatives to DSCR Financing

- Traditional mortgages: Lower rates if you have strong credit/income.

- Portfolio loans: Flexible terms for multi-property investors.

- Hard money: Fast but expensive; best short-term.

- Private money: Relationship-driven; negotiable terms.

- Cash purchase: No loan friction if capital allows.

- Seller financing: Flexible when banks won’t play.

When DSCR Isn’t the Best Fit

If the property needs heavy rehab or income is unproven, a DSCR lender may balk or price it high. Consider hard money or a bridge loan to stabilize, then refinance into DSCR once rents season. If you have W-2 stability and plan to house-hack, a conventional or FHA route can be cheaper. With elite credit and multiple doors, a portfolio line at a relationship bank can bundle properties and simplify management.

Key Takeaways

Remember these essentials when pursuing DSCR financing:

- Property-driven: Your rental’s income—not your paycheck—qualifies you.

- Risk awareness: Price prepay risk and income volatility.

- Shop smart: Compare rate, points, DSCR floor, LTV, IO years, and recourse.

- Be ready: Keep reserves and core documents handy.

- Monitor: Track DSCR and act before issues compound.

Frequently Asked Questions

Conclusion

DSCR loans are a powerful tool. They let you scale your rental portfolio when traditional financing falls short. But their risks—higher rates, income volatility, and potential penalties—demand diligence.

If you’ve been wondering how to get a DSCR loan, start with your numbers, pick a property that truly cash flows, and compare lenders like a pro. Use the DSCR calculator above to see if your property qualifies today.

This guide is for educational purposes only and is not financial, legal, or tax advice. Mortgage products, underwriting standards, and pricing vary by lender and market. Verify figures independently and consult a licensed mortgage professional and qualified advisor before making financing decisions. We do not originate loans and do not endorse any specific lender.