Looking to invest smarter in 2025? DSCR lenders provide cash flow loans driven by your property’s rental income, not personal income, making them a top choice for real estate investors. This guide dives into the leading DSCR lenders, compares their metrics, and offers expert tips to choose the right partner to scale your portfolio.

Introduction: Why DSCR Lenders Matter in 2025

In today’s fast-paced real estate market, DSCR lenders have emerged as a go-to solution for investors seeking investment property financing without the burden of extensive income verification. As we head into 2025, the financing landscape is evolving rapidly, with traditional lenders tightening requirements and prioritizing owner-occupied properties. This shift has created a gap for real estate investors, making cash flow loans offered by DSCR lenders increasingly critical. Learn more about what DSCR loans mean for investors.

Unlike conventional loans that hinge on personal income, W-2 statements, and debt-to-income ratios, DSCR lenders focus on a property’s ability to generate cash flow through rental income. This approach is a game-changer for investors who might struggle under traditional guidelines, such as those managing multiple properties, self-employed entrepreneurs, or individuals with non-traditional income sources. In 2025, this flexibility is particularly valuable as rental demand remains robust, fueled by trends like urbanization, remote work, and a growing preference for renting over homeownership.

However, the road ahead isn’t without challenges. Rising interest rates, potential regulatory changes, and regional market variations could complicate financing for investors. DSCR lenders address these hurdles by offering a streamlined path to capital, enabling investors to seize opportunities in competitive markets. For example, an investor with a property generating $4,000 in monthly rental income can secure a loan based on that cash flow, even if their personal finances don’t align with bank standards. This direct focus on property performance simplifies the process and empowers investors to act swiftly when deals arise.

This guide delves into the top DSCR lenders for 2025, providing a comprehensive overview of how they operate, their key metrics, and actionable tips for selecting the right partner. Whether you’re eyeing single-family rentals, multi-family complexes, or short-term vacation properties, understanding cash flow loans can unlock new possibilities for your portfolio.

Dashboard visualizing DSCR lender terms for quick investor reference.

What Are DSCR Lenders?

DSCR lenders are financial institutions or private lenders specializing in cash flow loans that evaluate a real estate investment’s ability to cover its debt obligations. The cornerstone of their approach is the Debt Service Coverage Ratio (DSCR), calculated by dividing a property’s net operating income (NOI) by its total debt service (monthly principal and interest payments). For instance, a property generating $100,000 in annual NOI with an $80,000 annual debt service has a DSCR of 1.25, indicating it produces 25% more income than needed to cover the loan.

This cash-flow-driven model sets DSCR lenders apart from traditional banks, which rely heavily on an individual’s debt-to-income (DTI) ratio and documented income. By prioritizing property performance, DSCR loans make financing more accessible for investors with complex financial profiles, such as those juggling multiple properties or running their own businesses. For example, a landlord with irregular personal income but a portfolio of income-producing rentals can still qualify based on the strength of their properties’ cash flow. For more details, check out our guide on qualifying for a DSCR loan.

That said, investment property financing through DSCR lenders comes with trade-offs. Interest rates are typically 0.5% to 1.5% higher than conventional mortgages, reflecting the lender’s increased risk in focusing on property income rather than personal creditworthiness. Additionally, while credit scores and liquidity play a role in approvals, they’re secondary to the DSCR metric, which must often meet a minimum threshold (e.g., 1.15 or 1.25). Despite these costs, the streamlined documentation and faster underwriting process—sometimes completed in as little as two weeks—make DSCR lenders a compelling choice for investors aiming to grow efficiently.

Why DSCR Lenders Are Crucial to Real Estate Investors

Nearly 40% of new investment property loans in 2024 were sourced through DSCR lenders, reflecting growing trust in cash-flow-based investment property financing. This trend is set to accelerate in 2025 as investors seek flexible financing solutions to scale their portfolios rapidly.

For real estate investors, DSCR lenders are crucial because they align financing with the realities of property investment. By focusing on a property’s rental income rather than personal finances, they remove barriers for investors with unconventional income streams or high personal debt levels. This model paves the way for several key advantages:

- Faster Approvals: Fewer personal financial documents mean underwriting can take as little as 2–4 weeks, compared to 6–8 weeks for traditional loans.

- Higher Loan Amounts: Strong cash flow can unlock larger loans, enabling investors to acquire multi-family units or commercial properties.

- Flexibility: Many DSCR lenders accommodate niche investments like short-term vacation rentals, fix-and-flips, or multi-family properties. For insights on financing such properties, explore our mixed-use property loans guide.

Consider an investor with a multi-family property generating $10,000 monthly in rental income. Even if their personal income fluctuates, a DSCR lender would prioritize the property’s cash flow, potentially approving a larger loan than a bank would offer. This agility is invaluable in competitive markets where delays can cost deals. Moreover, as rental demand holds strong in 2025—driven by economic shifts and housing shortages—cash flow loans empower investors to capitalize on opportunities with fewer constraints, whether targeting single-family rentals or large apartment complexes. For tips on securing these loans, check out how to get a DSCR loan.

Top DSCR Lenders for 2025

Below are five noteworthy DSCR lenders poised to lead the market in 2025, each offering unique strengths for investors seeking cash flow loans:

- Skyline Funding Solutions

Known for lightning-fast approvals and a streamlined online application process, Skyline offers loan-to-value (LTV) ratios up to 80%. They specialize in single-family rentals and small portfolios, often closing deals in 10–14 days—a critical edge in hot markets. Their user-friendly platform makes it easy to upload property data, appealing to tech-savvy investors. - Pioneer Commercial Bank

Catering to both seasoned investors and newcomers, Pioneer offers specialized DSCR programs with a low minimum DSCR requirement of 1.15. Their focus on multi-family properties, combined with personalized service, makes them ideal for complex deals, though approvals may take 3–4 weeks due to thorough underwriting. - Integrity Capital Group

Integrity excels in short-term rentals and vacation properties, factoring in real-world occupancy rates for Airbnb and VRBO hosts. Their niche expertise ensures loan terms reflect the seasonal nature of these investments, making them a top pick for investors in tourist-heavy markets. Learn more about short-term rental loans. - Evergreen Lending Partners

A private lender prioritizing portfolio expansion, Evergreen allows cross-collateralization of multiple properties to secure larger loans. They’re a go-to for investors scaling quickly, though they require higher credit scores (700+). Their flexibility suits those bundling assets for growth. - MetroStar Financing

Offering competitive interest rates—often 0.25% to 0.50% above conventional loans—MetroStar excels in large multi-family deals. They demand robust property management documentation but deliver cost-effective investment property financing for experienced investors.

Comparing DSCR Lenders: Key Metrics

When it comes to DSCR lenders, the devil is in the details. From minimum DSCR ratios to credit score benchmarks, understanding each lender’s metrics is crucial.

| Criteria | Skyline Funding | Pioneer Bank | Integrity Group | Evergreen Lending | MetroStar Financing |

|---|---|---|---|---|---|

| Minimum DSCR | 1.20 | 1.15 | 1.20 | 1.25 | 1.25 |

| Credit Score Minimum | 680 | 650 | 660 | 700 | 680 |

| Max LTV | 80% | 75% | 75% | 80% | 75% |

| Primary Focus | Single-Family & SFR Portfolios | Mixed-Use & Multi-Family | Short-Term Rentals | Multi-Property Bundling | Large Multi-Family Deals |

| Typical Rates (Approx.) | +1.00% Over Conventional | +1.25% Over Conventional | +1.50% Over Conventional | +1.00% Over Conventional | +0.50% Over Conventional |

While Skyline Funding excels in rapid closings, Pioneer might offer more lenient DSCR requirements. If you’re venturing into short-term rentals, Integrity Group is often more flexible in how they calculate your rental income. To estimate potential mortgage payments for your investment, try our free Advanced Mortgage Calculator.

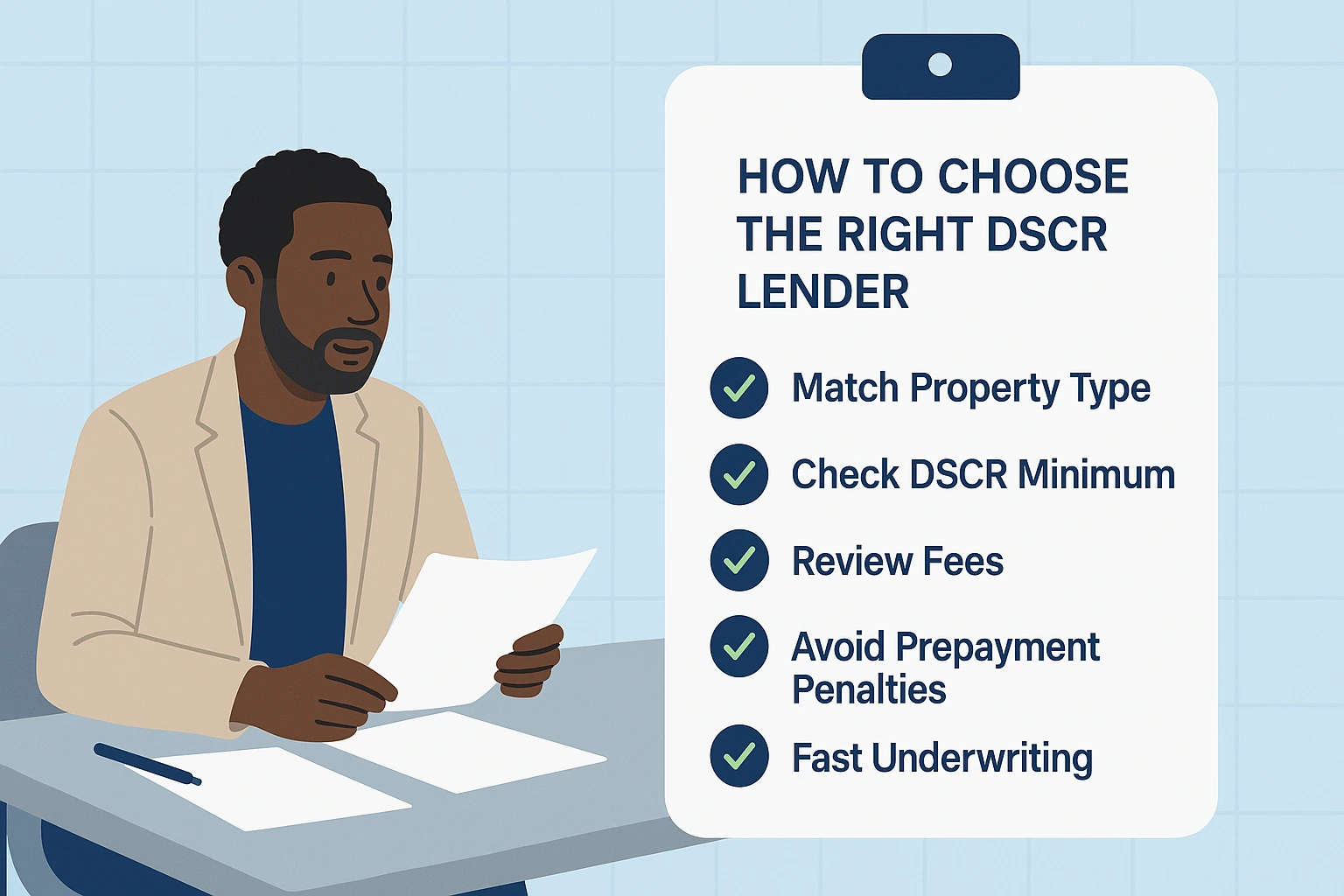

Step-by-step checklist to select a DSCR lender based on your investment needs.

How to Choose the Right DSCR Lender

Selecting the right DSCR lender is about more than just interest rates—it’s about finding a partner that aligns with your investment strategy. For a deeper dive, read our guide on choosing the best DSCR lender.

1. Match the Lender to Your Property Type

Some DSCR lenders specialize in single-family rentals, while others cater to multi-family or commercial properties. Ensure your lender regularly deals with the type of asset you plan to finance. For example, Integrity Capital Group might be better if you’re leaning into short-term vacation rentals, whereas MetroStar may have an edge for large multi-family complexes.

2. Assess Minimum DSCR Requirements

If your property’s DSCR is borderline—say around 1.15—you’ll want a lender known for approving lower coverage ratios. That might mean Pioneer, but be prepared for potentially higher interest rates or stricter terms to offset the added risk.

3. Evaluate Fees and Closing Costs

DSCR loans typically carry higher origination fees than conventional mortgages. But not all lenders are created equal. Some charge 1%–2% in origination fees; others might fold additional admin or legal fees into the package. Always request a Loan Estimate to understand the true cost of borrowing.

4. Look Into Prepayment Penalties

Many DSCR lenders include prepayment penalties to ensure they capture the expected interest. If you plan to refinance or sell your property in under five years, look for lenders offering low or no prepayment penalty. This flexibility can save you thousands of dollars if market conditions shift and a refinance becomes attractive.

5. Check the Lender’s Customer Support and Underwriting Speed

The DSCR loan process can be swift or drawn out, depending on the lender’s underwriting protocols. Skyline Funding touts a quick approval pipeline, which can be invaluable if you’re under a tight closing deadline or dealing with a competitive market.

Expert Analysis

Expert Insight: “Choosing a DSCR lender is akin to choosing a long-term partner. It’s not just about the stated interest rate but also the lender’s flexibility and understanding of real estate cycles. When you find a lender who can adapt terms based on your strategy, you give yourself a major competitive advantage.” — Sarah Johnson, Real Estate Portfolio Strategist

Critical Bulleted Summary

- Expertise Matters: Lenders who specialize in your property type often expedite approvals and offer tailored solutions.

- DSCR Benchmarks Vary: Some lenders accept DSCR as low as 1.15, while others want at least 1.25.

- Rates & Fees: Expect slightly higher rates than a conventional mortgage and pay close attention to origination fees.

- Prepayment Penalties: If you plan to refinance, look for low or no penalty structures.

- Underwriting Speed: Rapid approvals can make or break a deal in competitive markets.

Key Takeaways

- 1. DSCR lenders focus on cash flow: Your property’s rental income drives approval more than your personal income.

- 2. Minimum DSCR standards matter: Look for lenders who accept the DSCR your property can realistically achieve.

- 3. Shop Around: Compare at least 3–5 DSCR lenders on rates, fees, and closing timelines to find the best fit.

- 4. Documentation helps: Lease agreements, occupancy rates, and expense projections bolster your case.

- 5. Future Flexibility: If you anticipate refinancing or property expansion, consider lenders that minimize penalties and facilitate portfolio growth.

FAQ Section

Are DSCR lenders more expensive than traditional banks?

Yes — I’ve found DSCR loans often run 0.5%–1.5% higher in interest than bank mortgages. The trade-off? Less paperwork and faster approvals, which saved me time on a recent deal. Compare rates to find the best fit.

Can I still apply if my personal credit score is under 620?

It’s tough, but possible. I’ve seen lenders accept scores around 600, though my rate was higher. Shop around — some DSCR lenders focus more on property cash flow than credit.

Do I need experience as a real estate investor?

Not always. My first DSCR loan was approved despite being a newbie, thanks to strong rental income. Some lenders prefer experience, but solid property docs can seal the deal.

How quickly can I close with a DSCR lender?

I’ve closed in as little as 2 weeks with a DSCR lender. Most take 2–4 weeks, depending on the deal’s complexity. Fast underwriting is a huge plus in competitive markets.

Who are the best DSCR lenders?

I’ve had great experiences with Skyline Funding for fast closings and Integrity Capital for Airbnb properties. The best depends on your needs — compare LTVs and rates. Check out lender tips for more.

What are DSCR lenders?

DSCR lenders focus on your property’s cash flow, not personal income. I used one for a rental with strong NOI, and they approved it based on the DSCR ratio. They’re perfect for investors.

What is a good DSCR for a loan?

A DSCR of 1.25 or higher worked well for me — lenders love it. Some accept 1.15, but you might face stricter terms. Higher ratios mean better loan options.

What are the minimum requirements for a DSCR loan?

My lender required a 680 credit score, 1.20 DSCR, and 6 months’ reserves. Requirements vary, but strong cash flow is key. Check Forbes’ guide for more details.

Don’t Let Cash Flow Kill the Deal

Get Up to $50K in DSCR-Friendly Personal Loans