Denied because of DTI? Here’s how to use DSCR loan requirements to qualify on cash flow—not W-2s. We’ll show the minimums vs. the sweet spots and how to nudge your numbers higher. New to the concept? Start with our DSCR loan explained primer.

DSCR Calculator

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- What Is a DSCR Loan?

- DSCR Loan Requirements at a Glance

- Why DSCR Loans Work for Investors (And What You Must Hit)

- DSCR vs. Traditional Mortgages

- How Lenders Evaluate Your DSCR (And How to Boost It)

- Prepayment Penalties (What to Expect)

- Hidden DSCR Loan Requirements Most Investors Miss

- The Application Process (3 Steps to Approval)

- Key Takeaways

- FAQ

What Is a DSCR Loan?

A DSCR loan evaluates the property first. Lenders assess whether the asset’s income can service the debt—independent of your personal DTI—by checking it against program-specific DSCR loan requirements.

Formula: DSCR = Net Operating Income (NOI) ÷ Total Debt Service (monthly P&I). NOI = rent (plus other property income) − operating expenses (taxes, insurance, maintenance, management, etc.). A DSCR ≥ 1.00 means income covers debt; most lenders want a cushion. This is the debt service coverage ratio lenders use, grounded in a simple NOI calculation. For a neutral definition of DSCR, see this overview.

DSCR Loan Requirements at a Glance

- Minimum DSCR: Common floors 1.20–1.25; limited cases reviewed near ~1.15 with strong compensating factors.

- Credit score: ~620 minimum; 680+ helps pricing/LTV.

- Down payment/LTV: Plan on 20–25% down (75–80% LTV typical).

- Reserves: 6–12 months of PITI is common.

- Docs: Leases/rent roll or market rent, plus appraisal and proof of insurance/taxes.

Pro tip: Hitting 1.30–1.40 often improves pricing and may support higher leverage within program limits—one of the most actionable ways to stand out.

Why DSCR Loans Work for Investors (And What You Must Hit)

Want to scale faster? DSCR programs look at the property first. Hit the DSCR target, keep your credit solid, and let the appraisal support market rent—then underwriting usually feels simpler than DTI-heavy options.

Minimum DSCR: Commonly 1.20–1.25; some specialty programs may review ~1.15 with compensating factors (liquidity/collateral).

Credit score: Floors around 620; 680+ usually unlocks better pricing/LTV.

Appraisal/rent support: Market-rent schedule and condition drive the income side of the equation.

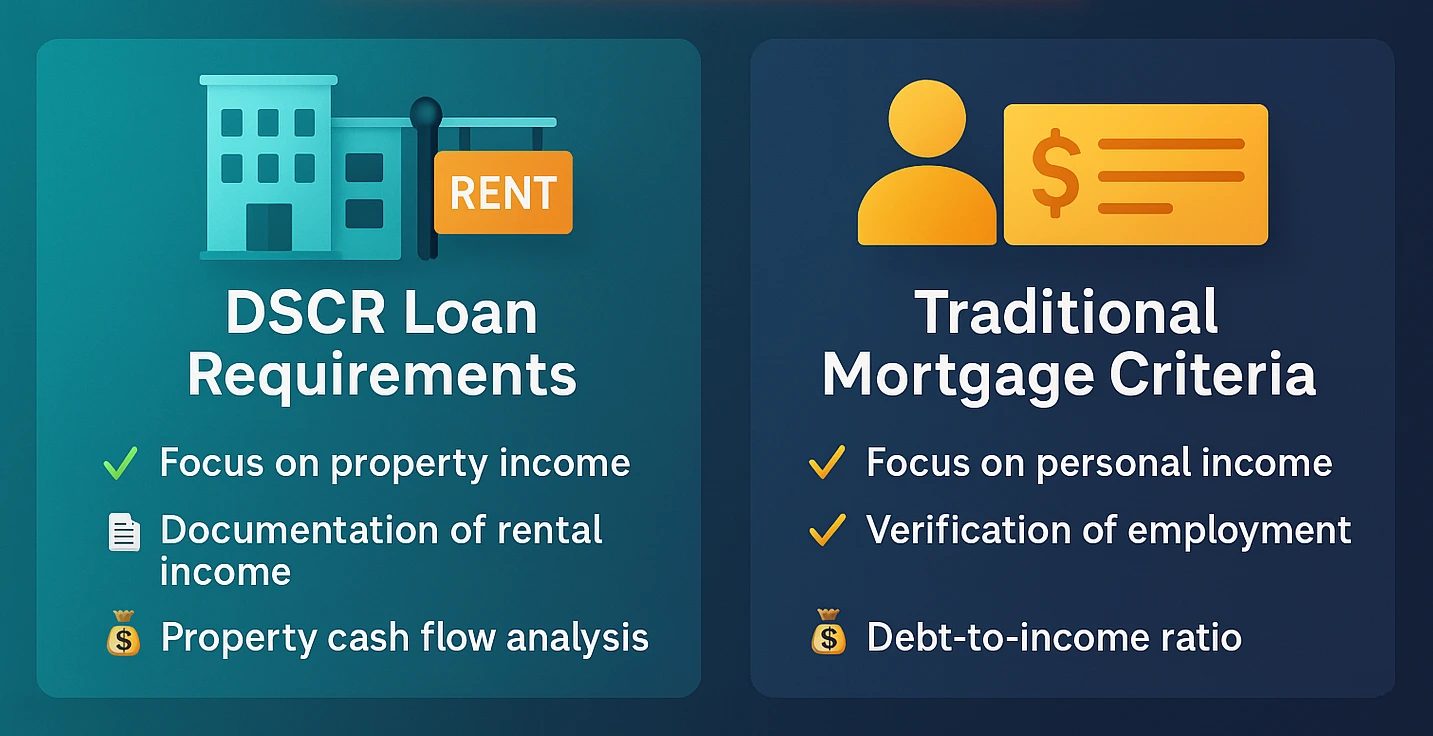

DSCR vs. Traditional Mortgages

Here’s how DSCR loans compare to traditional mortgage options:

| Key Metrics | DSCR Loan Requirement | Traditional Mortgage |

|---|---|---|

| Primary Qualification | Property DSCR & cash flow | Personal income & DTI |

| Typical DSCR Range | 1.15–1.25+ | N/A (focus on borrower DTI) |

| Credit Score Minimum | ~620 (stronger pricing at 680+) | Can be lower (e.g., 580 for FHA) |

| Loan-to-Value (LTV) | Typically 75–80% | Up to 95%+ on some programs |

| Interest Rates | Often slightly higher vs conventional | Often lower, but tighter borrower vetting |

| Approval Speed | Fast once property income is verified | Can be slower (income docs & overlays) |

Real Approval Case Study (Illustrative)

Scenario: Rent $3,100 + other income $200; operating expenses $800; proposed P&I $1,800.

NOI: ($3,100 + $200) − $800 = $2,500.

DSCR: $2,500 ÷ $1,800 = 1.39.

Outcome: Meets typical thresholds and sits above many 1.25 floors, so pricing and LTV tiers can be stronger (exact terms vary by lender/market). This simple NOI calculation shows how small income or expense shifts can change your terms.

How Lenders Evaluate Your DSCR (And How to Boost It)

What they review: expected gross income (leases or market rent), operating expenses (taxes, insurance, maintenance, management), monthly debt service (P&I), and stress factors like vacancy and reserves. Short-term rentals may need permits or historical booking data; DSCR loans often ask for proof of licensing in STR markets. If the stabilized ratio clears program floors, you’re inside the key program thresholds—exceeding them can earn better terms.

Prepayment Penalties (What to Expect)

Most DSCR loans include a prepayment penalty. The common structure is a “step-down” (for example, 5–4–3–2–1 over the first five years), but some lenders use yield maintenance or a lockout period. Read the term sheet closely before you sign. If you plan to refinance or sell early, price that cost into your returns. Stronger DSCR and credit can sometimes improve terms or open a version of the program with a shorter step-down. Knowing how penalties work is just as critical as meeting the core DSCR program criteria.

Terms like prepayment penalties and DSCR floors vary by lender and state. Confirm details with a licensed mortgage professional before you apply or refinance.

Hidden DSCR Loan Requirements Most Investors Miss

Down payment & LTV: Expect 20–25% down (typical LTV caps 75–80%). Higher DSCR or stronger credit can sometimes improve tiers within program limits.

Reserves: Six to twelve months of PITI is common. Strong reserves compensate for borderline ratios.

Documentation: Leases, rent rolls (multi-unit), or appraisal-supported market rent. STRs may require permits and booking history.

Red-flag checklist: Overstated market rent; ignoring HOA/utility burdens; unseasoned STR income; major deferred maintenance; undisclosed liens; thin reserves. Fix these before you apply to avoid surprises.

The Application Process (3 Steps to Approval)

1) Pre-check & scenario: Share credit range, property details, and rent assumptions; lender runs an initial DSCR against its program thresholds.

2) Underwriting & appraisal: Appraisal sets value and market-rent schedule; underwriting validates income, expenses, reserves, and DSCR vs. program minimums.

3) Terms & closing: With DSCR ≥ the floor, negotiate LTV, term, and any prepayment penalty; clear conditions (title/insurance) and schedule closing.

Key Takeaways

Bottom line: meet the baseline and aim higher where you can.

To satisfy common DSCR requirements, target 1.20–1.25 DSCR (1.30–1.40 preferred), keep scores 620+ (680+ for best tiers), plan 20–25% down and 6–12 months of reserves, and document rent thoroughly. With DSCR loans, a higher ratio typically improves pricing and leverage within program caps.

Frequently Asked Questions

Conclusion

Master these DSCR requirements, stress-test your numbers, and move forward with clarity. When you’re ready to dig deeper, loop back to the DSCR explainer for the full foundations.

This article is for educational information only and is not credit, legal, tax, or investment advice. Terms and availability vary by lender and jurisdiction and may change. Always verify details with your lender and consult qualified professionals. Examples and calculator outputs are estimates, not commitments to lend; all financing must comply with applicable laws and fair housing rules.