Choosing the best DSCR lenders can make or break your year—especially if you’re scaling rentals and want approvals based on cash flow. Because these loans look at property income, not your W-2, they’re built for scale. For a quick primer, check out our guide on dscr loan explained. We’ll break down what makes a lender “best” for your portfolio, from multi-unit pros to quick-close specialists.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Why DSCR Lenders Matter for Your 2025 Strategy

- What Is a DSCR Loan?

- Top DSCR Lenders (2025 Rankings)

- How to Select a DSCR Lender

- Expert Insights

- Common Pitfalls to Avoid

- Key Takeaways

- FAQs

- Conclusion & Next Steps

Why DSCR Lenders Matter for Your 2025 Strategy

Rates are up and underwriting is tighter this year, so plays that cash-flow win. These programs are based on a property’s income, not a borrower’s pay stubs, which lets self-employed landlords and portfolio owners move faster with fewer documents. If you invest in mixed-use, DSCR financing can work there, too—see our guide on mixed-use property financing. Top perks include skipping tax returns for cash-flow approvals, Airbnb-friendly projected income, and fix-and-flip bridges even below 1.0 DSCR—useful for scaling without W-2 hurdles. Learn more about short-term rental loans in our guide.

What Is a DSCR Loan?

A DSCR loan (Debt Service Coverage Ratio) evaluates Net Operating Income against annual debt payments (DSCR = NOI ÷ Annual Debt Service). A DSCR of 1.2 means the property generates 20% more income than needed to cover the loan. Typical minimums range from 1.0–1.25, with some stretching to 0.75 for strong files. Because DSCR is the gating ratio, lender thresholds directly shape fit and pricing for your deal. For eligibility details, see how to qualify for a DSCR loan.

Now that you know the basics, plug in your numbers with our quick calculator to see what loan size fits your NOI.

Quick DSCR Calculator

Auto-updates as you typeDSCR Loan Requirements (Quick Look)

Most programs set DSCR loan requirements around a 1.0–1.25 coverage ratio, 20–30% down, and 3–12 months of reserves. Scores near 640–680 are common cutoffs, with stronger credit helping pricing and exceptions. Properties should be rent-ready at closing; complex rehabs usually need bridge financing first.

Best DSCR Lenders & DSCR Loan Rates (2025)

In 2025, DSCR loan rates typically range around 6.5%–7.5% for many investors, depending on term, property type, and credit profile. Based on 2025 market shifts—like stricter underwriting for some STR markets and more focus on documented expenses—these providers stand out for reliability.

Our ranking considers investor reviews and market data to highlight the lenders that excel in rates, terms, and on-time closings. If you focus on short-term rental loans, prioritize lenders with documented STR experience and projected-income underwriting; Lima One and similar programs often lead here.

Rates and terms change frequently by market and borrower profile; examples here are illustrative. Always verify with a written quote.

Our Top Picks

- Ridge Street Capital – Among the top providers for multi-unit properties, offering up to 80% LTV and financing for complexes up to 25 units. Rates start at 6.5% with a 1.0 DSCR minimum.

- MoFin Lending – Great for self-employed investors, with flexible income verification and a 640 credit score minimum. Rates start at 6.75%.

- Constitution Lending – Reported closings as fast as four days. Ideal for single-family rentals with a low 0.75 DSCR requirement and rates from 7.0%.

- Kiavi – Investor-friendly with no prepayment penalties after 3 years. Rates from 7.25% and a 680 credit score requirement.

- RCN Capital – Strong for portfolio investors, with competitive 7.25% rates and a focus on investment expertise.

- Lima One Capital – Specialized short-term rental programs with rates at 7.25% and 80% LTV.

- New Silver Lending – No minimum DSCR, useful for tighter deals. Offers 80% LTV but slower closings (21–30 days) and higher rates (7.5%+).

Compare Key Metrics

*Data as of October 2025. Programs change—always verify with a written, same-day quote.

| Lender | Loan Range | Starting Rate | Min. DSCR | Max. LTV | Min. Credit Score | Closing Timeframe | Notes |

|---|---|---|---|---|---|---|---|

| Ridge Street Capital | $200k–$5M | 6.5% | 1.0 | 80% (purchase) | 660 | 14–21 days | Finances properties up to 25 units |

| MoFin Lending | $150k–$3M | 6.75% | 1.0 | 75% (purchase) | 640 | 14–21 days | Excellent for self-employed investors |

| Constitution Lending | $100k–$2M | 7.0% | 0.75 | 80% (purchase) | 660 | 7–14 days | Reported closings as fast as four days |

| Kiavi | $100k–$3M | 7.25% | 1.0 | 80% (purchase) | 680 | 14–21 days | No prepayment penalty after 3 years |

| RCN Capital | $150k–$3M | 7.25% | 1.0 | 80% (purchase) | 660 | 14–21 days | Strong focus on investment property expertise |

| Lima One Capital | $100k–$3M | 7.25% | 1.0 | 80% (purchase) | 660 | 21–30 days | Specialized short-term rental programs |

| New Silver Lending | $100k–$2M | 7.5% | No minimum | 80% (purchase) | 620 | 21–30 days | No minimum DSCR requirement |

| Angel Oak | $150k–$2M | 7.75%+ | 1.25 | 75–80% | 680 | 21–30 days | 40-yr fixed w/ interest-only options |

How to Select a DSCR Lender

If you’re comparing the best DSCR lenders, start with asset fit (SFR, small multi, STR), then screen on DSCR threshold—a tighter 1.0 may point you to New Silver, while stronger DSCR unlocks better pricing. Line up fees using Loan Estimates, and weigh speed if you’re competing—Constitution has reported closings as fast as four days. If you plan to exit early, favor lighter prepay rules like Kiavi’s after three years. Most lenders will price-match close offers—ask. Use the DSCR loan calculator above to sanity-check your target payment and loan amount before requesting quotes.

Investor Spotlight: A Phoenix landlord pivoted to Constitution for a 5-day close after a competing buyer appeared. The rate was slightly higher, but the on-time close saved the deal and roughly $8,000 in projected holding costs—proof that speed and reliability can outweigh a tenth of a point on rate.

Expert Insights

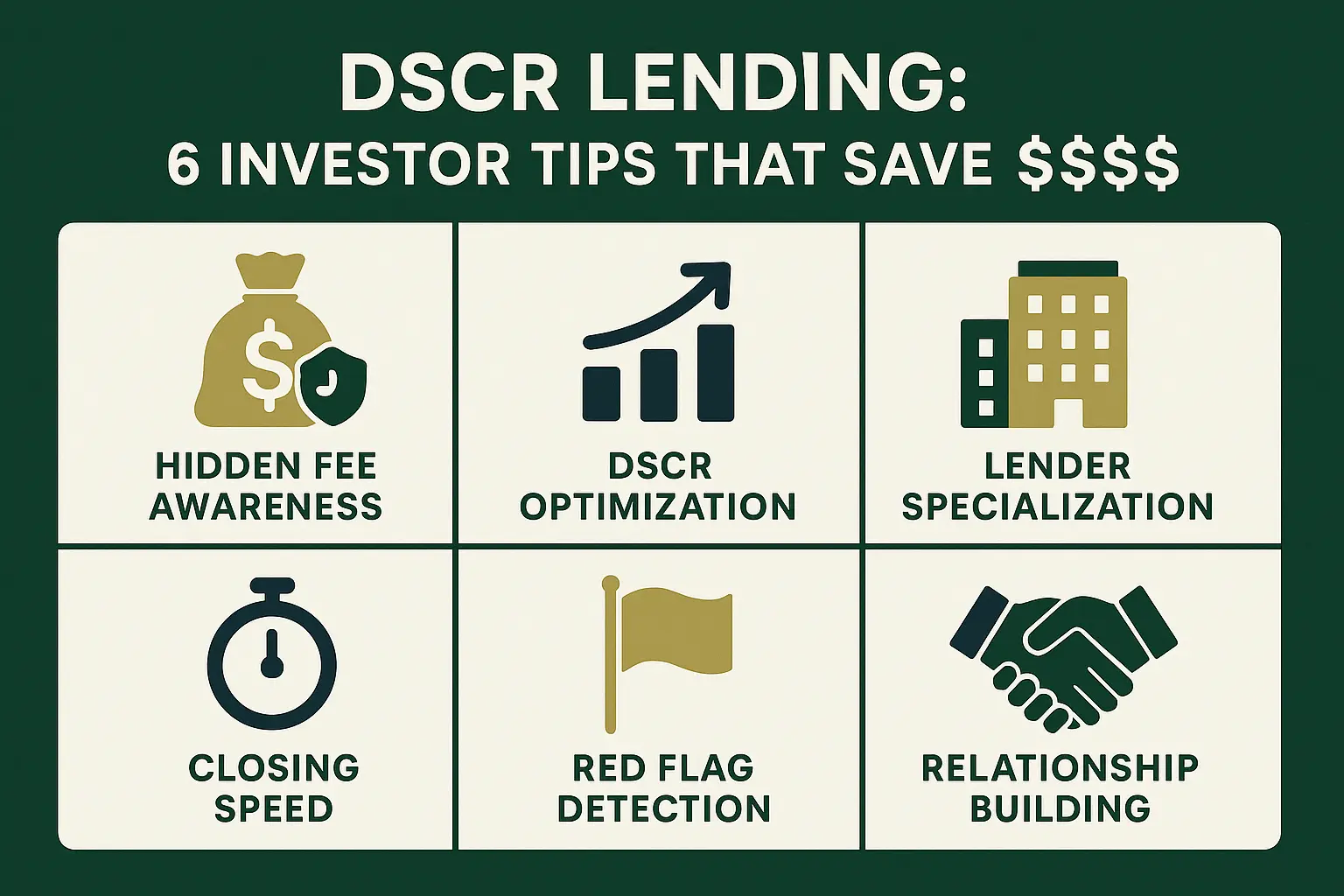

The biggest mistake investors make when selecting a DSCR lender is focusing exclusively on interest rates. Hidden fees, closing reliability, and flexibility when challenges arise often change the real cost. The best choice isn’t always the lowest advertised rate—it’s the one whose total cost structure and service quality match your plan.

Common Pitfalls to Avoid with DSCR Lenders

Rate myopia. Chasing the lowest headline rate can backfire if you ignore all-in costs. Origination, processing, points, and prepayment penalties can add five figures to your total. Fix: request same-day, written quotes from two or three lenders and compare APR, fee line items, and prepay terms—not just the note rate.

Asset mismatch. Some lenders shine on single-family and small multis, others focus on short-term rentals or small apartment buildings. If your property type isn’t their sweet spot, you risk slower underwriting or stricter DSCR hurdles. Fix: shortlist lenders that regularly fund your property type and ask for recent deal examples.

No relationship. One-off deals miss perks like faster exceptions, more flexible conditions, and occasional pricing breaks. Fix: build a relationship with 2–3 lenders; close cleanly; share your pipeline early. Repeat borrowers often see smoother approvals and better long-run economics over time.

Key Takeaways

- Total cost beats headline rate: compare APR, fees, and prepay terms—not just the note rate.

- Fit + speed matter: pick lenders aligned to your asset type and timeline; on-time closings can be worth modestly higher pricing.

- Play the long game: build 2–3 lender relationships for smoother underwriting and better long-run terms.

Frequently Asked Questions

Conclusion & Next Steps

You don’t need the absolute lowest headline rate—you need the lender whose total cost and timeline fit your plan. Narrow to two or three options from our top picks, request written quotes the same day, and compare fees and prepay terms side by side. If you’re new to DSCR, read our step-by-step guide, then circle back for quotes.

This article is for informational and educational purposes only and is not financial, legal, or tax advice. Programs, rates, and underwriting standards change frequently and can vary by lender, location, and borrower profile. Always verify current terms directly with licensed lenders and consult your professional advisors before making financing decisions. This content is editorial and independent; no compensation was accepted for rankings.