Frustrated with your modular home loan? You’re not alone. Many buyers dream of a sleek, energy-efficient modular home—custom-built, affordable, and ready in months. But when it comes time to finance, hidden roadblocks can leave you stuck. You’ve submitted the paperwork, picked a floor plan, and yet your loan stalls. Sound familiar?

Here’s the truth: modular homes are financeable like site-built homes, but only if you meet strict Modular Home Loan Requirements. Miss a single step, and your dream could be delayed or denied. The biggest hurdles? Foundation classification, HUD-tag verification, and land title issues.

In this ultimate guide, we’ll break down these common financing hurdles, provide step-by-step solutions, and give you an interactive checklist to track your progress. You’ll also get expert tips, myth-busting insights, and guidance on choosing the right lender and builder to keep your financing on track. For the full picture on modular home financing — including requirements, loan types, and expert strategies — check out our modular home loan. Let’s clear the path to your new home!

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- What Sets Modular Home Loan Requirements Apart?

- Hurdle #1: Foundation Classification Confusion

- Hurdle #2: HUD-Tag and Serial Number Verification

- Hurdle #3: Land Title and Ownership Issues

- Financing Options for Modular Homes

- Interactive Checklist: Modular Home Loan Readiness

- Choosing the Right Lender and Builder

- Debunking Myths About Modular Home Loans

- Frequently Asked Questions About Modular Home Loans

- Pro Tips for Mastering Modular Home Financing

- Common Mistakes to Avoid

- Key Takeaways for Modular Home Loan Success

- Ready to Conquer Modular Home Financing?

What Sets Modular Home Loan Requirements Apart?

Modular homes are constructed in factory sections, transported to your land, and assembled on a permanent foundation. Unlike manufactured homes (mobile homes), they adhere to the same local, state, and federal building codes as site-built homes, often making them eligible for conventional, FHA, VA, or USDA loans when program requirements are met. However, financing faces unique challenges:

- Construction Loans: Financing often includes a construction phase, adding complexity.

- Misclassification Risks: Confusion with manufactured homes can lead to incorrect loan types.

- Rigorous Appraisals: Lenders scrutinize foundations, HUD compliance, and land titles to ensure the home is real property.

Mastering these lending requirements unlocks better rates and terms. Let’s tackle the three hurdles that catch most buyers off guard.

Hurdle #1: Foundation Classification Confusion

Why It’s a Deal-Breaker

Lenders require your modular home to be permanently attached to a foundation that meets local building codes, HUD, or FHA standards. A temporary foundation (e.g., unanchored piers) or misclassification can relegate your loan to a chattel loan (higher rates, shorter terms) or result in denial.

Common Pitfalls:

- Foundation doesn’t extend below the frost line or lacks proper drainage.

- Appraiser can’t verify permanent attachment due to missing permits.

- Local code enforcement records are incomplete.

How to Beat It

- Confirm Foundation Type: Ensure your builder installs a permanent foundation (e.g., crawl space, basement) compliant with local codes.

- Secure Documentation: Obtain building permits and inspections confirming compliance with seismic, soil, or frost-line standards.

- Get Certified: Hire a licensed structural engineer to provide a foundation compliance letter, verifying structural integrity.

- Prepare for Appraisal: Submit all documentation (permits, certifications, photos) to your lender before the appraisal. Request the appraiser to document the foundation’s compliance.

Get Certified Tip

- Hire a Licensed Engineer: Request a foundation compliance letter detailing code adherence (e.g., frost-line depth, seismic standards).

- Verify Credentials: Ensure the engineer is licensed in your state.

- Submit Early: Provide the letter to your lender with other foundation documents to avoid appraisal delays.

Pro Tip: Engage an engineer early to review foundation plans, avoiding costly rework. If the appraisal is unclear, request a revision to confirm compliance.

Example: Jane in Colorado faced a loan delay because her foundation lacked a perimeter enclosure. By hiring an engineer to certify the foundation and adding a concrete enclosure, she cleared the hurdle in two weeks.

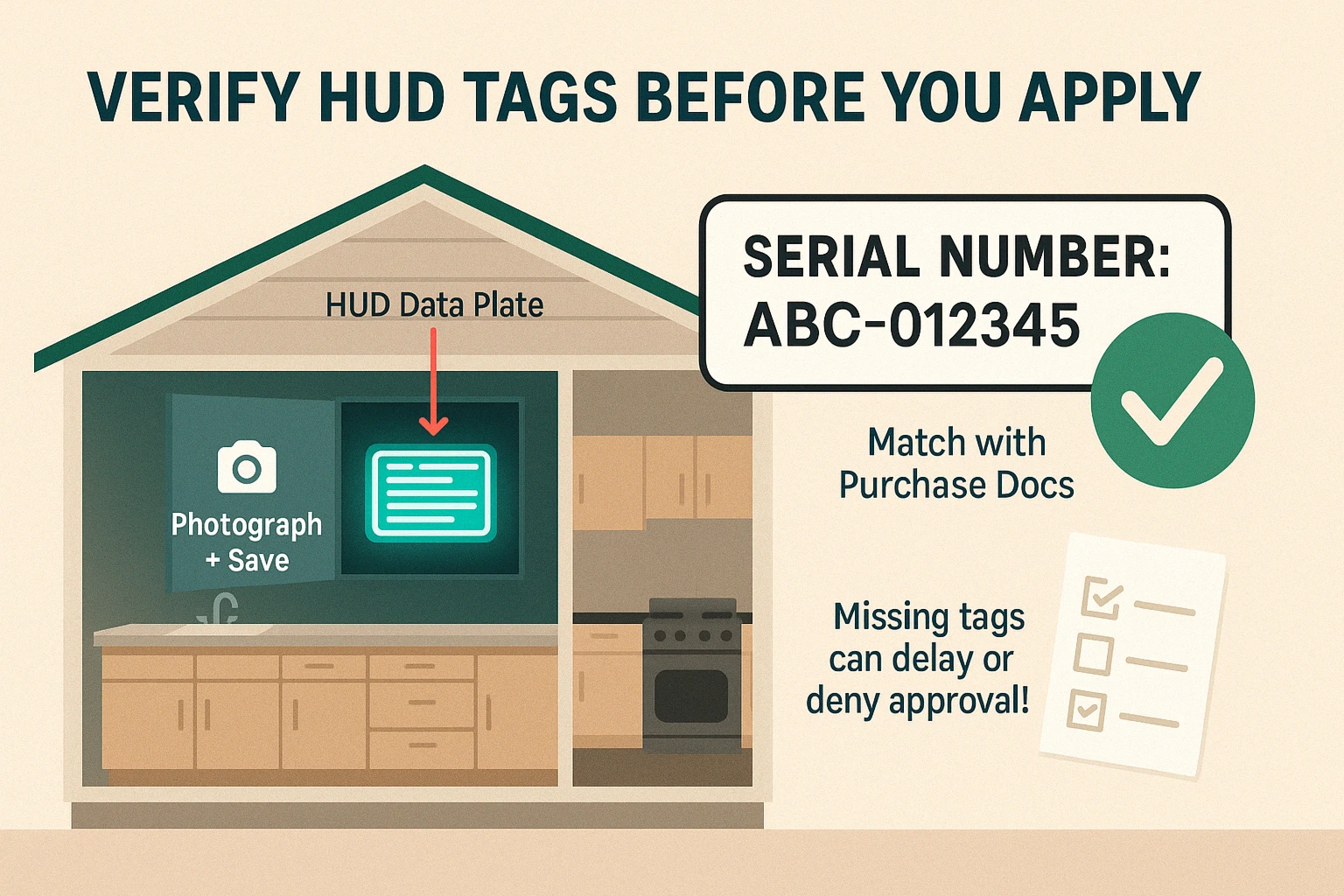

Hurdle #2: HUD-Tag and Serial Number Verification

Why It’s a Deal-Breaker

Modular homes must comply with HUD standards, verified through HUD data plates and serial numbers. Lenders need these to confirm the home is modular (not manufactured) and eligible for conventional financing. Missing, illegible, or mismatched tags can halt your loan.

What Lenders Need:

- HUD data plate (inside a cabinet, closet, or near the electrical panel).

- Serial numbers matching your purchase agreement.

- Proof of HUD code and local building standard compliance.

How to Beat It

- Locate HUD Tags: Check each home section for data plates and exterior HUD tags.

- Photograph and Document: Take clear photos of tags and note their locations.

- Cross-Check Serial Numbers: Verify numbers with your builder’s documents and manufacturer records.

- Resolve Issues: If tags are missing or illegible, contact the manufacturer or a HUD-approved inspector for replacements or verification.

HUD-Tag Verification Checklist

- Locate: Find data plates (e.g., in kitchen cabinets) and exterior HUD tags.

- Photograph: Capture clear images of all tags and serial numbers.

- Cross-Check: Confirm numbers match your purchase agreement.

- Confirm with Lender: Submit photos and verification to your lender or hire a HUD-approved inspector if issues persist.

Pro Tip: If verification is delayed, hire a HUD-approved inspector to provide a compliance report.

Example: Tom in Texas found a faded HUD tag. By contacting the manufacturer with his home’s serial number, he received a verification letter in 10 days, clearing his loan.

Hurdle #3: Land Title and Ownership Issues

Why It’s a Deal-Breaker

A clear, marketable title is essential for modular home financing. Lenders must confirm you own the land free of liens, easements, or boundary disputes. Any title defect can delay or derail your loan.

Common Title Issues to Watch For

- Liens: Unpaid debts (e.g., taxes, contractor bills) attached to the property.

- Easements: Rights granted to others (e.g., utility access) that may affect property value.

- Boundary Disputes: Disagreements with neighbors over property lines.

- Unclear Ownership: Gaps in the title chain raising doubts about legal ownership.

How to Beat It

- Order a Title Search: Hire a title company or attorney to check for liens, easements, or disputes.

- Resolve Defects: Pay off liens, negotiate easement releases, or settle boundary disputes with a surveyor.

- Secure Title Insurance: Protect against undiscovered defects to reassure your lender.

- Obtain a Clear Title Commitment: Request a formal commitment from the title company confirming the title is free of significant issues.

Pro Tip: If buying land and home together, insist on a simultaneous closing to streamline title transfers. Order a land survey to verify boundaries and avoid encroachments.

Example: Sarah in Florida discovered an old tax lien during her title search. By working with a title attorney to settle the debt, she secured a clear title commitment in three weeks, saving her loan.

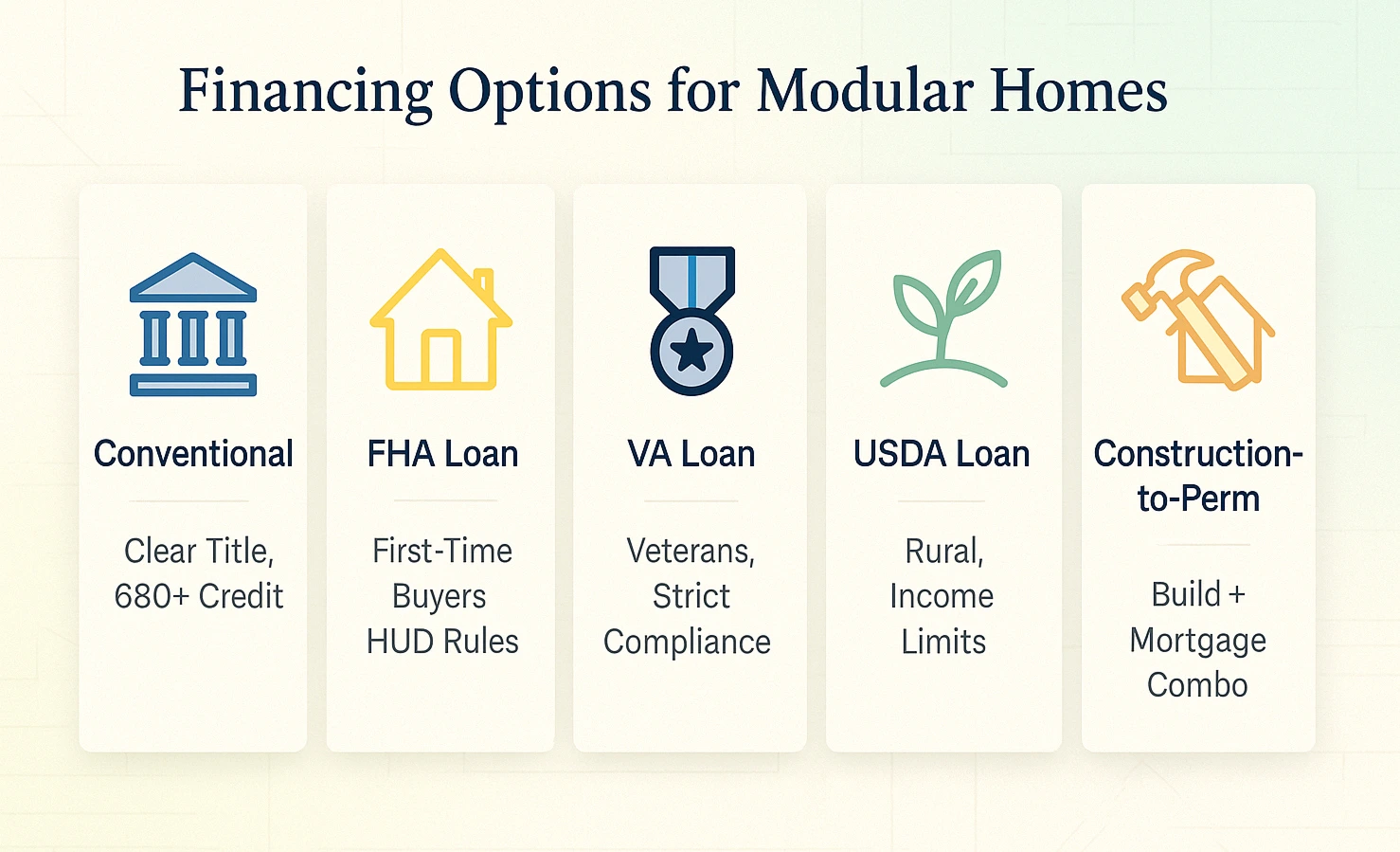

Financing Options for Modular Homes

When financing a modular home, meeting the key criteria unlocks multiple options. Explore these with our free mortgage calculator to estimate payments, and compare modular vs. manufactured home loans to find the right fit.

- Conventional Mortgages: Best for permanent foundations and clear titles. Many lenders look for scores around 680+, but requirements vary by program and profile.

- FHA Loans: Ideal for first-time buyers. Needs HUD compliance and foundation certification.

- VA Loans: For veterans, with strict foundation and HUD standards.

- USDA Loans: For rural areas, with income and property eligibility requirements.

- Construction-to-Permanent Loans: Covers manufacturing and installation, converting to a mortgage post-construction.

Pro Tip: Get pre-approved first—it sets a clear budget and makes your offer harder to turn down.

Interactive Checklist: Modular Home Loan Readiness

Check off each step to ensure your modular home loan is ready—your progress updates in real time.

Tap or click items to mark them complete.

Choosing the Right Lender for Modular Home Financing

Finding a Lender for Modular Home Financing

Not all lenders are equipped to handle modular home loans—choose one with experience to avoid delays.

- Experience: Ask about their history with modular loans (e.g., “Have you funded 3–5 modular home projects?”).

- Loan Options: Look for conventional, FHA, VA, or USDA loans tailored to modular homes.

- Rates and Fees: Compare interest rates and closing costs across multiple quotes.

- Customer Service: Check reviews or ask for client references to ensure responsiveness.

Lender Types (streamlined): Local banks and credit unions tend to be flexible and understand regional codes, national lenders bring broad product menus and competitive pricing, and specialty lenders focus on modular nuance end-to-end. Pick the fit that matches your documentation comfort level and timeline.

Selecting a Reputable Builder

Your builder’s experience with financing requirements is critical. Choose wisely:

- Track Record: Select a builder with 3–5 successful modular loan projects.

- Reputation: Review feedback from past clients and local forums.

- Documentation: Ensure they provide timely permits, HUD tags, and engineer certifications.

Pro Tip: Get pre-approved to clarify your budget and strengthen your offer. Verify your builder’s loan experience during initial consultations.

Debunking Myths About Modular Home Loans

Clear up misconceptions to approach financing with confidence:

- Myth: Modular homes are hard to finance.

Reality: With proper documentation, they’re as financeable as site-built homes. - Myth: Modular homes depreciate.

Reality: Value depends on location, condition, and market trends. - Myth: Modular homes are low-quality.

Reality: Built to the same codes as site-built homes, often with superior factory quality control. - Myth: Modular homes are mobile homes.

Reality: Modular homes are permanently fixed and follow stricter codes.

Frequently Asked Questions About Modular Home Loans

Pro Tips for Mastering Modular Home Financing

Use these tips to streamline your process and use our Free Home Affordability Calculator to plan your budget:

- Start Early: Gather permits, title reports, and HUD tags before applying.

- Work with Experts: Choose lenders and builders with proven modular experience (e.g., 3–5 loan projects).

- Double-Check Details: Mismatched serial numbers or missing certifications can cause delays.

- Stay Organized: Use our checklist to track progress and share with your team.

- Explore Assistance: Check for down payment programs or USDA loans for rural areas.

Common Mistakes to Avoid

| Mistake | Why It Hurts | How to Prevent |

|---|---|---|

| Assuming builder handles all docs | Lenders need original certifications | Keep copies and verify with lender |

| Delaying title search | Liens can block closing | Order search early |

| Ignoring HUD tag issues | Mismatches stall approval | Verify tags before appraisal |

Key Takeaways for Modular Home Loan Success

- Prepare Thoroughly: Ensure foundation, HUD tags, and title meet financing requirements.

- Choose Wisely: Partner with experienced lenders and builders.

- Act Quickly: Address issues early to avoid delays.

- Use Tools: Leverage our checklist to stay organized.

Ready to Conquer Modular Home Financing?

Navigating modular home financing can be challenging, but with the right preparation, you’ll secure your dream home in no time. Use our interactive checklist, partner with a modular-savvy lender and builder, and stay proactive.

Next Steps (streamlined): Download the checklist so you can share it with your lender and builder, contact a specialist for pre-approval or title help, and share this guide with anyone who’s considering a modular build.

For more resources, visit HUD.gov.

This guide is for informational purposes only and is not financial, legal, or tax advice. Mortgage eligibility, credit score requirements, and program rules change frequently and vary by lender and location. Consult a licensed mortgage professional, a HUD-approved housing counselor, or a real estate attorney for advice about your specific situation.