🏡 Overwhelmed by modular home finance? You’re not alone—but you’re in the right place! Financing a modular home can feel like navigating a maze of jargon, paperwork, and uncertainty. But what if you had a clear, beginner-friendly roadmap to guide you from your first lender call to closing day? This guide breaks down your financing plan into three simple stages: choosing the right loan, meeting requirements, and securing approval. With 2025 loan rates, expert tips, and a free interactive checklist, you’ll master modular home finance this year. For a broader look at the entire topic, be sure to check out our modular home loan guide. Let’s get started!

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Why Modular Home Finance Is Unique

- Choosing the Right Modular Home Loan

- Meeting Modular Home Financing Requirements

- Securing Your Modular Home Loan

- Interactive Checklist: Your Modular Home Financing Journey

- Common Mistakes to Avoid

- Expert Tips for Affordable Modular Home Financing

- Frequently Asked Questions

- The Future of Modular Home Finance

- Conclusion: Your Modular Home Awaits

Why Modular Home Finance Is Unique

Modular homes—built in factories and assembled on-site—offer affordability, speed, and customization. But financing them isn’t quite like a traditional mortgage. Lenders require specific conditions, like a permanent foundation and real property classification, which can trip up first-time buyers. For policy guidance, see Fannie Mae’s Selling Guide on factory-built housing eligibility for modular and related homes.

Fannie Mae: Modular/factory-built eligibility (Selling Guide)

Here’s the good news: With the right plan, affordable modular home financing is straightforward. This guide simplifies the process into three stages, ensuring you know exactly what to expect—no jargon, just clarity for your modular home financing journey.

| Feature | Modular Home Loan | Traditional Mortgage |

|---|---|---|

| Loan Options | FHA, VA, Conventional, Chattel | Mostly Conventional, FHA, VA |

| Down Payment | 0–20% | 3–20% |

| Appraisal | Required (permanent foundation) | Required |

| Interest Rates | 6.0–8.5% (2025) | 6.0–7.5% (2025) |

Choosing the Right Modular Home Loan

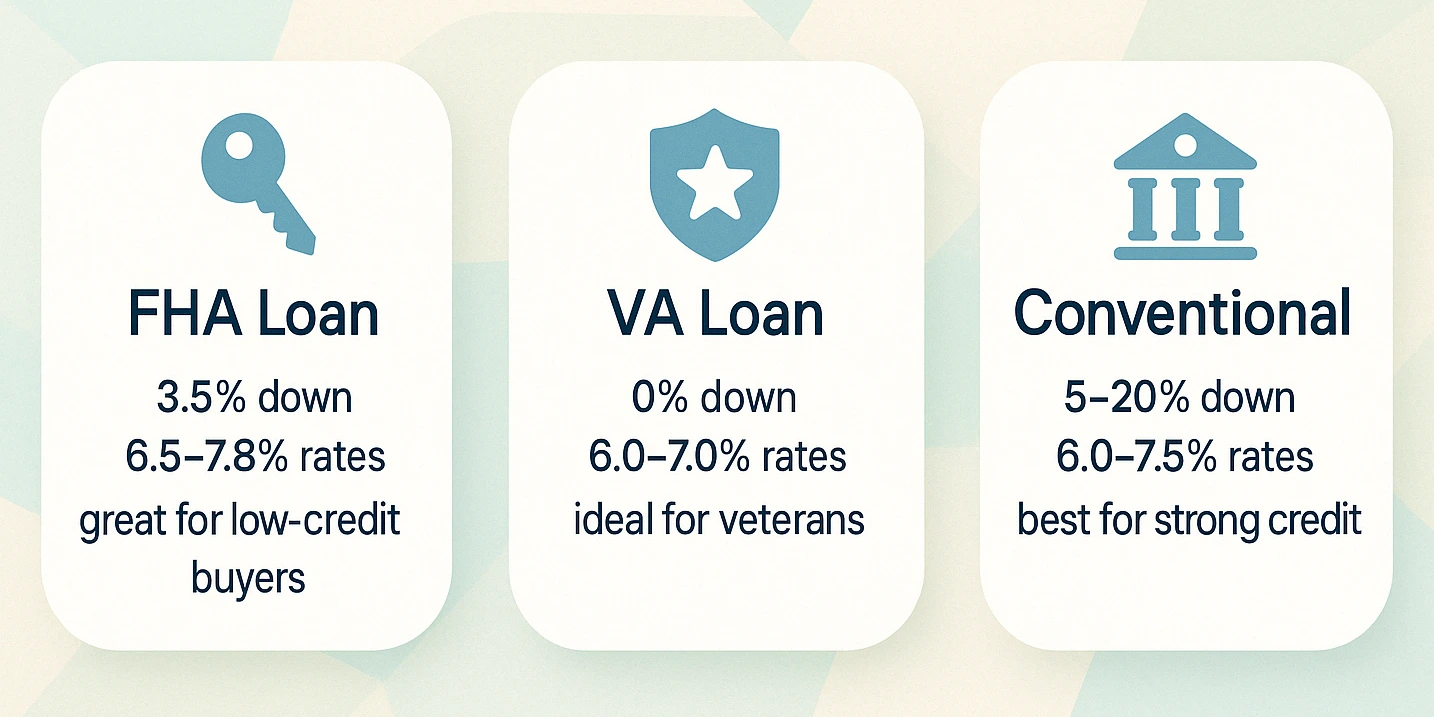

The first step in modular home financing is picking the loan that fits your budget and goals. Modular homes qualify for many of the same loans as site-built homes, but each has unique benefits and trade-offs for financing a modular purchase. Compare modular home loans from at least three lenders to balance rate, fees, and closing timeline.

Top Loan Types for Modular Homes (2025)

FHA Loan

3.5% down, 6.5–7.8% rates, great for low-credit buyers.

VA Loan

0% down, 6.0–7.0% rates, ideal for veterans.

Conventional

5–20% down, 6.0–7.5% rates, best for strong credit.

| Loan Type | Best For | Down Payment | Rate Range (APR) | Pros | Cons |

|---|---|---|---|---|---|

| Conventional Mortgage | Strong credit buyers | 5–20% | 6.0–7.5% | Competitive rates, no PMI with 20% down | Stricter credit requirements |

| FHA Loan | First-time/low-credit buyers | 3.5% | 6.5–7.8% | Low down payment, flexible credit | Requires mortgage insurance |

| VA Loan | Veterans & service members | 0% | 6.0–7.0% | No down payment, no PMI | Eligibility restrictions |

| USDA Loan | Rural buyers | 0% | 6.3–7.0% | No down payment, low rates | Rural area, income limits |

| Construction-to-Perm | New builds on owned land | 5–20% | 7.0–8.5% | Covers build + mortgage | Higher rates, more paperwork |

| Chattel Loan | Non-permanent homes | 5–10% | 7.5%–9.5% | Fast approval, leased land | Higher rates, shorter terms |

2025 Modular Home Loan Rates

| Loan Type | Rate Range (APR) |

|---|---|

| FHA Loan | 6.5%–7.8% |

| VA Loan | 6.0%–7.0% |

| Conventional Loan | 6.0%–7.5% |

| USDA Loan | 6.3%–7.0% |

| Construction-to-Perm | 7.0%–8.5% |

| Chattel Loan | 7.5%–9.5% |

Meeting Modular Home Financing Requirements

Once you’ve chosen a loan, it’s time to gather documents and meet lender criteria. Preparation is key to a smooth process. Use our free Home Affordability Calculator to estimate your budget and avoid surprises.

Modular Home Loan Requirements (2025)

- Credit Score: Aim for 620+ for conventional (700+ for best rates). FHA often works at 580+ with 3.5% down, or 500–579 with 10% down; VA/USDA lenders may accept 580–620+.

- Down Payment: Ranges from 0% (VA/USDA) to 20% (conventional). Saving more can lower your rate and may eliminate PMI.

- Debt-to-Income (DTI): Keep monthly debts at or below ~43% of gross income. Example: at $5,000/month, total debts (including mortgage) ≈ $2,150.

- Appraisal & Foundation: The home must appraise at or above the loan amount and sit on a permanent foundation to qualify as real property.

- Paperwork Checklist: Expect pay stubs, W-2s, two years of tax returns, recent bank statements, photo ID/SSN, a purchase agreement or builder contract, and a land deed if applicable.

Securing Your Modular Home Loan

This final stage is where your preparation pays off. Follow these steps to secure approval and close on your plan—then finish financing a modular home with confidence. Try our free Mortgage Calculator to estimate payments.

Step-by-Step Approval Process

- Get Pre-Approved (1–3 Days): Share income, credit, and debt details so your lender can issue a budget-setting letter and identify any red flags early.

- Select Your Modular Home & Sign (1–2 Weeks): Choose a reputable builder and sign the purchase contract. Ensure code requirements are met — HUD for manufactured homes; IRC/local code for modular homes.

- Appraisal & Inspection (1–2 Weeks): Your lender orders an appraisal to confirm value; verify the property is titled as real property and has a permanent foundation.

- Underwriting (2–4 Weeks): The lender validates documents and risk; respond quickly to document requests to keep timelines on track.

- Closing & Move-In (1–2 Days): Sign final documents, pay 2–5% in closing costs, and collect your keys. 🔑

Interactive Checklist: Your Modular Home Financing Journey

Stay on track with our interactive checklist for your financing steps! Click each task to toggle progress—your progress bar will update automatically.

Your Modular Home Financing Tracker

Common Mistakes to Avoid

- Skipping Pre-Approval

- Fix: Get pre-approved early to set your budget and strengthen your offer.

- Ignoring Closing Costs

- Fix: Budget 2–5% of the loan amount for fees like appraisals and title insurance.

- Choosing an Inexperienced Lender

- Fix: Ask lenders about their modular home financing experience.

- Underestimating Appraisal Requirements

- Fix: Ensure your builder provides the documentation your lender requests.

- Not Shopping Around

- Fix: Compare rates from at least three lenders.

Expert Tips for Affordable Modular Home Financing

- Lock in Rates Early: Secure your rate after pre-approval to avoid market fluctuations.

- Improve Your Credit: Pay down debts and avoid new credit inquiries before applying.

- Choose a Reputable Builder: Lenders favor builders with proven experience in this space.

- Explore Down Payment Assistance: Some states offer grants for first-time buyers.

- Download Our Free Guide: Get our printable modular home financing checklist to stay on track!

Frequently Asked Questions

The Future of Modular Home Finance

As modular homes gain popularity, financing options are expanding. In 2025, expect:

- More lenders offering specialized modular home financing loans.

- Online platforms streamlining applications and rate comparisons.

- Increased support for energy-efficient modular homes, potentially lowering rates.

This evolution makes now an ideal time to explore affordable modular home financing!

Conclusion: Your Modular Home Awaits

Financing a modular home doesn’t have to be daunting. By choosing the right loan, meeting requirements, and following our step-by-step checklist, you’ll navigate modular home financing with confidence. Whether you’re a first-time buyer or a veteran, your dream home is closer than you think.

Take the first step now: Use our interactive checklist, compare lenders, and get pre-approved today. Your journey to an affordable modular home starts here!

This article provides general educational information about modular and manufactured home financing. It isn’t financial, legal, or tax advice. Always confirm eligibility, rates, and requirements with a licensed lender and your local authorities before making decisions.