Short term property loans have been a game-changer for real estate investors like me, letting you jump on time-sensitive deals with speed. Unlike traditional mortgages, these loans offer fast funding for projects like house flipping, short-term rental acquisitions (think Airbnb or VRBO), or bridging financial gaps. With repayment terms from six months to three years, their flexible requirements and quick approvals help you stay ahead in competitive markets. Whether you’re gutting a fixer-upper for a quick flip or outfitting a beach house for VRBO guests, these loans can cut through red tape to keep your momentum. For a broader understanding of financing options, check out our comprehensive guide on investment property loans.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Types of Short-Term Financing Options

- Compare Short-Term Property Loans vs. Alternatives

- Qualify (Short-Term Rental Loans)

- Choosing the Right Loan for Investment

- Tips for Success (Speed, Costs, Exit)

- What’s Next for Short-Term Financing

- Frequently Asked Questions

- Conclusion

Types of Short-Term Financing Options

Short term property loans come in different flavors, each suited to specific real estate strategies. As an investor, I’ve leaned on these to tackle everything from quick flips to vacation rentals. Here’s a rundown of the main options you can explore:

1. Bridge Loans

Bridge loans act as a financial stopgap, providing immediate capital while you await long-term financing or the sale of another property. They’re useful for keeping deals alive during transitions, typically lasting 6 months to 3 years with up to 80% LTV and variable rates—plus fees like origination and appraisals. They’re best for transitions but watch for prepayment penalties and repayment risks if sales delay.

| Duration | LTV | Rates |

|---|---|---|

| 6 mo–3 yr | Up to 80% | Often 7–12% (variable) |

Example: An investor might spot a prime property but still be selling another investment. A bridge loan funds the purchase, and it’s repaid after the sale closes, aiming to secure a solid opportunity.

2. Hard Money Loans

Hard money loans, backed by the property’s value, are offered by private lenders who prioritize asset potential over borrower credentials. They’re a go-to for speed-driven projects, running 6 months to 2 years with up to 70% LTV and often double-digit rates, alongside origination and closing costs. Fast funding and lenient criteria make them shine for flips, though higher fees mean you’ll want a tight exit plan.

| Duration | LTV | Rates |

|---|---|---|

| 6 mo–2 yr | Up to 70% | ~10–15% |

Example: An investor grabs a rundown property with solid resale potential using a hard money loan. After renovations, it’s sold, repaying the loan and targeting a profit.

3. Fix-and-Flip Loans

Fix-and-flip loans bundle purchase and renovation costs, designed for investors aiming to refurbish and resell properties swiftly. They’re common for well-planned flips in hot markets, spanning 6 to 18 months with up to 90% LTV for purchase and up to 100% for renovations, at rates typically higher than traditional but lower than many hard money offers—plus origination, appraisal, and draw fees.

| Duration | LTV | Rates |

|---|---|---|

| 6–18 mo | Up to 90% purchase, 100% reno | ~8–12% |

Example: Use a fix-and-flip loan to buy and upgrade a fixer in a trending neighborhood. Funds are released as renovations progress, then you sell or refi to exit.

4. Short Term Rental DSCR Loans

Short-term rental DSCR loans evaluate a property’s rental income, useful for platforms like Airbnb. These can run 1 to 5 years with up to 80% LTV and rates competitive with other investor products, including standard origination and closing costs. The property-income focus and favorable LTV are strengths, though they hinge on market demand and occupancy.

| Duration | LTV | Rates |

|---|---|---|

| 1–5 yr | Up to 80% | Often ~6–9% |

Example: Finance a coastal condo in a tourist hotspot with a DSCR loan, leveraging projected short-term rental income to qualify.

Compare Short-Term Property Loans vs. Alternatives

When comparing short term property loans, key metrics like duration and LTV stand out—especially versus slower routes when you need bridge loans or hard money financing for speed.

| Loan Type | Typical Duration | LTV | Interest Rates | Speed of Funding | Risk Level | Ideal For |

|---|---|---|---|---|---|---|

| Bridge Loan | 6 months to 3 years | Up to 80% | Higher, often variable | Fast | Moderate | Bridging gaps |

| Hard Money Loan | 6 months to 2 years | Up to 70% | Very high | Very Fast | High | Fix-and-flip |

| Fix-and-Flip Loan | 6 to 18 months | Up to 90% & 100% renovation | Higher, lower than hard money | Fast | Moderate | Experienced flippers |

| Short Term Rental DSCR Loan | 1 to 5 years | Up to 80% | Competitive | Moderate | Moderate | Short-term rentals |

Reality Check: Deal Math

Say a $250K flip with 10% hard money at 11%, held 6 mo: Interest ~$11K, fees ~$5K, total cost ~$16K. Sell at $320K? Net might land near ~$49K after all, depending on closing costs and taxes.

Loan terms, rates, and fees vary by lender and market. Consider reviewing the Consumer Financial Protection Bureau’s guidance on mortgage costs and points to understand trade-offs and risks.

How to Qualify for Short Term Rental Loans (Eligibility & Docs)

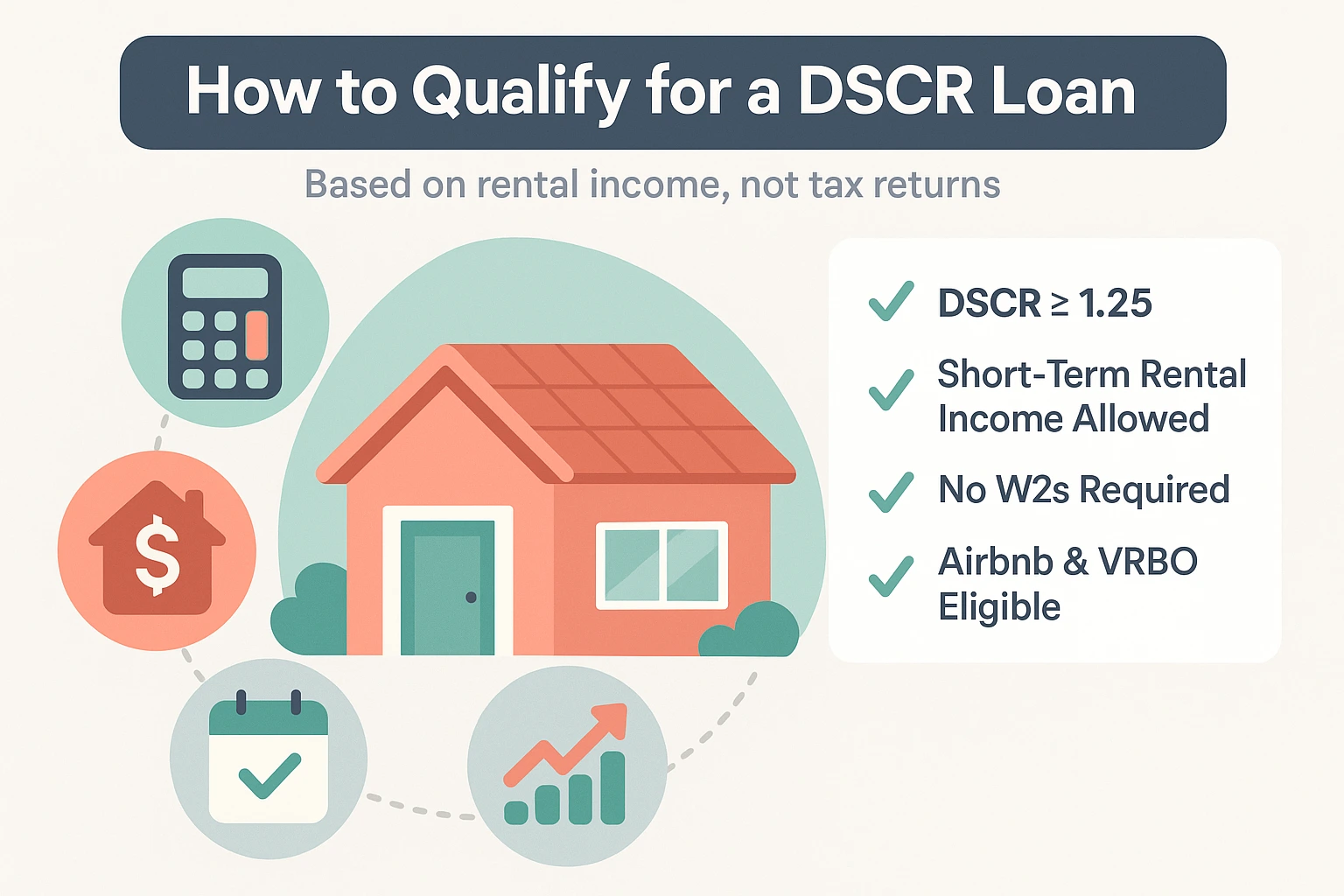

To qualify for short term property loans, lenders focus on the property’s potential and your investment experience more than conventional credit rules. Start with credit (a score of 600–680 is commonly sufficient, with higher unlocking better rates), LTV (expect lower ratios requiring larger down payments to mitigate lender risk), and a professional appraisal assessing the property’s current and post-renovation value. Beyond basics, lenders look at your renovation plan (fix-and-flip loans may require a comprehensive blueprint with costs and schedules), experience (proven projects can enhance approval odds), and exit strategy (sell the property or refinance). For short-term rental loans, a DSCR near 1.25 or higher is often preferred, supplemented by alternative income documentation like bank statements, asset portfolios, or past project profits.

Choosing the Right Loan for Investment

Selecting the ideal short term financing depends on your project goals, timeline, budget, and lender credibility. Start by aligning with your project type—whether a lightning-fast flip via hard money financing or a steadier rental with DSCR—while weighing your timeline (hard money shines for rapid needs, bridge for longer) and risk tolerance (hard money carries higher stakes; DSCR can offer steadier paths). Once aligned, shop smart on interest rates and fees to fit your budget, prioritizing lenders with strong reputations via reviews and BBB ratings—see the CFPB’s points overview for clarity on costs.

Prepare contingencies for surprises and keep your crew tight—contractors, agents, and your lender. If you’re using a hard money lender, timelines can slip fast; add buffers so your costs don’t balloon.

Underwriting Essentials for Airbnb Financing (Checklist)

- Detailed budget

- Timeline with milestones

- Clear exit (sale/refi)

- Contractor quotes

- Local comps (Zillow/Redfin)

- 6 mo reserves

Short Term Loan Cost Calculator

Slide or type to estimate costs—values update live.

Range: $50,000–$500,000

Typical: 6%–15%

Typical: 6–36 months

Total Repayment: $0

Interest Cost: $0

Monthly Payment: $0

Tips for Success (Speed, Costs, Exit)

First off, thorough research through trusted industry sources can set you up strong, paired with a rock-solid budget—try our free mortgage calculator to nail projections and craft a detailed renovation plan outlining scope, costs, and timelines for fix-and-flip projects. Staying on schedule helps minimize holding costs, while clear communication with lenders on milestones builds trust.

Prepare contingencies for surprises and keep your crew tight—contractors, agents, and your lender. If you’re using a hard money lender, timelines can slip fast; add buffers so your costs don’t balloon.

What’s Next for Short-Term Financing

In 2025, short-term financing remains active, fueled by ongoing interest in short-term rentals and fix-and-flip opportunities. With interest rates that may be stabilizing, demand for flexible financing can stay high, making these loans a staple for agile investors. Tech like AI-assisted underwriting may shorten timelines, and green loans for eco-flips are rising—think solar incentives that can improve overall ROI.

Frequently Asked Questions

Conclusion

Short-term financing can unlock fix-and-flip or short-term rental opportunities. By understanding loan types, how to qualify, and market trends, you can move faster with a clearer plan. Back to basics? See our investment property loans pillar. Explore more tools at our tools page to power your next project.

Disclaimer. Educational content only—not financial, legal, tax, or investment advice. Short-term real-estate loans carry significant risk and costs. Rates, terms, fees, and eligibility vary by lender and location and change over time. Always verify requirements with a licensed lender and consult qualified professionals before making decisions. Last updated: 2025-10-28.