Ready to grow your Airbnb or Vrbo income but finding conventional mortgages too slow or strict? Short term rental loans can help you boost your cash flow with faster timelines, less paperwork, and investor-friendly terms. Whether you’re scaling your portfolio or launching your first vacation rental, understanding these options helps you act fast. If you’re weighing vacation rental financing versus a conventional mortgage, the breakdown below shows how each path works so you can move from research to action. For a broader look at financing strategies beyond STRs, check out our complete guide on investment property loans.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- Why Short Term Rental Loans Are a Game-Changer

- How STR Financing Outshines Traditional Mortgages

- Requirements at a Glance

- STR Loan Finder (Interactive)

- Types of Vacation Rental Loans for High ROI

- Calculating Income for STR Financing

- Get Approved Fast: Qualify & Accelerate

- Lender & Investor Insights

- Real-Talk Pitfalls (and Fixes)

- FAQs About Short Term Rental Financing

- Conclusion: Launch Your STR Portfolio with Confidence

Why Short Term Rental Loans Are a Game-Changer

Short-term rental demand continues to reshape real-estate investing, but traditional mortgages weren’t built for the fast, entrepreneurial pace of STRs.

Short-term rental financing can offer closing speed, income-based qualification, and business-friendly options that work for individuals or entities.

Did you know?

Many STR loans require little to no personal income documentation—useful for hosts with variable income or investors reinvesting earnings.

How STR Financing Outshines Traditional Mortgages

| Feature | Traditional Mortgage | Short Term Rental Loan |

|---|---|---|

| Approval Speed | Often 30–60 days | Often a few weeks (program-specific) |

| Income Verification | W-2s, tax returns, pay stubs | Property rental income (projected or historical, per lender) |

| Borrower Type | Individuals | Individuals, LLCs, Corporations |

| Property Use | Owner-occupied, long-term rental | Short-term rental, vacation, investment |

| Debt Service Coverage Ratio | Not always required | Commonly used (many programs look for ~1.10–1.25+) |

| Loan Purpose | Purchase, refinance | Purchase, refinance, cash-out, rehab |

| Documentation | Extensive | Often minimal |

Heads-up: Program guidelines vary. Many lenders look for DSCR around ~1.10–1.25, credit scores around the mid-600s, and LTVs commonly up to ~80%—but specifics differ by lender and market. Consider consulting a licensed mortgage professional or the CFPB’s mortgage resources for neutral shopping guidance.

Requirements at a Glance

Typical vacation rental financing benchmarks (vary by program):

- Min FICO (many programs): ~660+

- Max LTV (common): ~75–80%

- Min DSCR (common): ~1.10–1.25

- Down Payment: ~15–25%

- Entity Borrowing: LLCs/corps commonly allowed

STR Loan Finder (Interactive)

Pick your priority and sort or filter. On mobile, rows become cards for easy tapping.

| Loan Type | Approval Speed | STR Income Used? | Documentation | LLC Allowed? | Best For |

|---|

Types of Vacation Rental Loans for High ROI

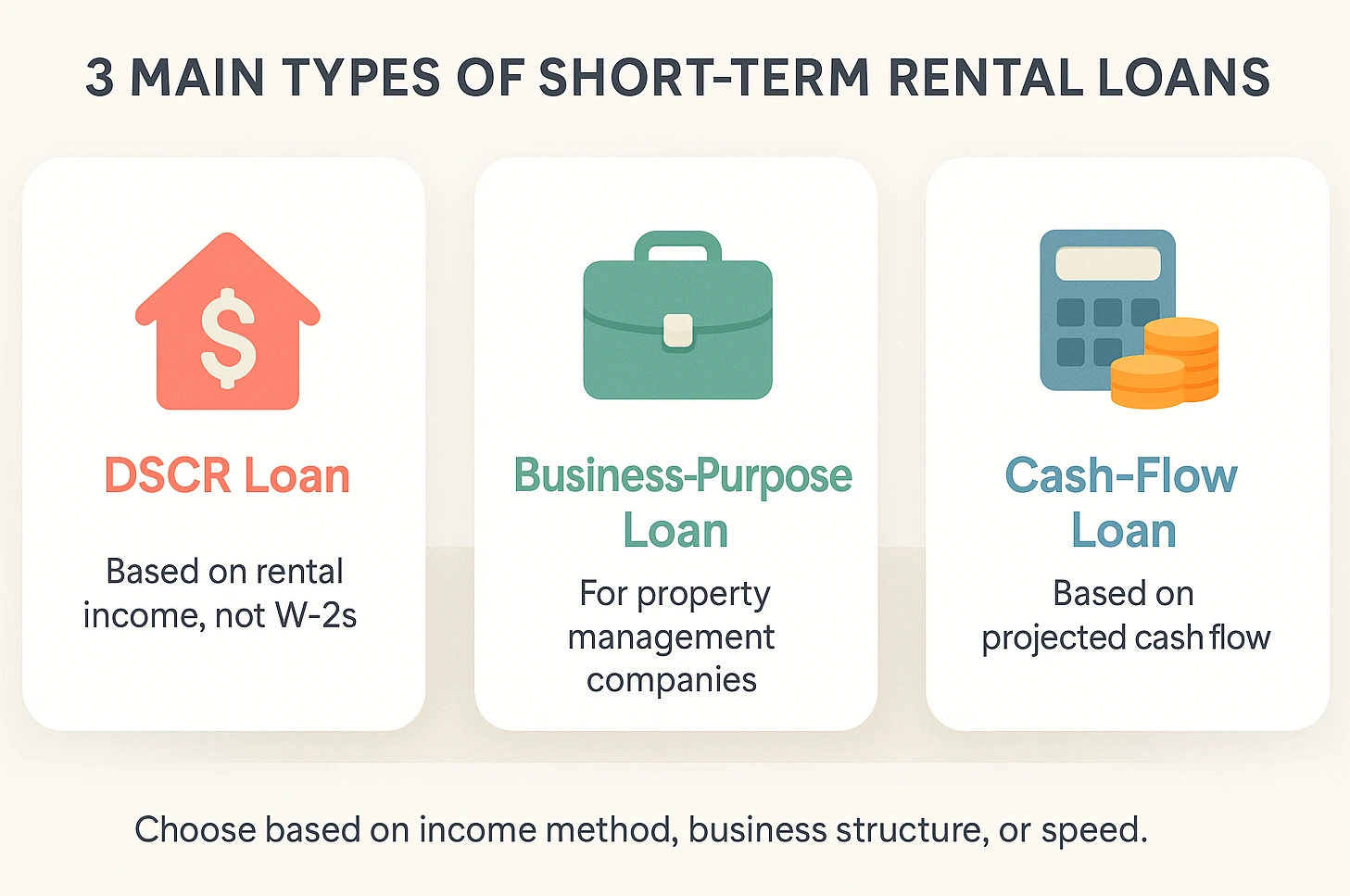

Not all STR loans are created equal. Here are the three most common paths:

DSCR Loans for Short Term Rental Financing

DSCR loans are a favorite with STR investors because they judge the deal by property cash flow, not pay stubs. Put simply, DSCR equals gross rental income divided by monthly debt obligations; a DSCR of 1.0 means income exactly covers payments, while many lenders prefer something around 1.10–1.25 or higher.

Why it matters: if projected or historical Airbnb/Vrbo income comfortably covers the payment, you may qualify with lighter personal documentation—useful for scaling multi-property portfolios.

Business-Purpose STR Loans for Investors

These programs—often marketed as Airbnb loans—are designed for investors and are often asset-based. Borrowing via an LLC or corporation is common, and terms can support purchase, rehab, refinance, or cash-out—with documentation that can be lighter than conventional mortgages.

Debt-Coverage/Cash-Flow Loans for Airbnb Investments

These focus on the property’s ability to cover expenses and debt, sometimes using projected STR income. They can pair with other loan types to accelerate approvals.

Calculating Income for STR Financing

Some lenders consider projected or historical income from Airbnb, Vrbo, or similar platforms—often with tools like AirDNA or a comparative market analysis. Others may require documented history if available.

How Lenders Project STR Loan Income

- Nightly Rate: Average rate per night (based on comps).

- Occupancy Rate: Percent of nights booked (seasonality and local trends matter).

- Gross Monthly Income: Nightly Rate × Occupancy × Days in Month

- Net Operating Income: Gross Income – Expenses (cleaning, management, utilities, etc.)

- DSCR: Net Operating Income / Monthly Debt Payments

Example Income Calculation for Vacation Rental Loans

| Factor | Value |

|---|---|

| Nightly Rate | $200 |

| Occupancy Rate | 70% (21 days/month) |

| Gross Monthly Income | $4,200 |

| Expenses | $1,500 |

| Net Income | $2,700 |

| Mortgage Payment | $2,000 |

| DSCR | 1.35 |

Pro Tip:

“Strong nightly rates help, but borderline occupancy can drag DSCR below thresholds—optimize listing appeal and pricing before applying.”

Get Approved Fast: Qualify & Accelerate

What lenders need: property details (address, photos, listing link if available), credible STR income projections or history, operating expenses (management, cleaning, taxes, insurance), entity documents for LLC/corp borrowing, a solid credit profile (many programs prefer mid-600s+), and funds for a typical 15–25% down payment.

How to move faster: assemble STR income estimates first, keep business paperwork tidy, and have recent bank statements/asset documentation ready. Missing projections or incomplete entity docs are common delays—solve those first to shorten timelines on any Airbnb loan application. For neutral shopping tips, see the CFPB’s guide to comparing loan offers.

Lender & Investor Insights

“Short term rental loans have changed how investors scale Airbnb portfolios—closings can happen in weeks, not months.”

— Lender insight

“Strong nightly rates help, but borderline occupancy can drag DSCR below thresholds—optimize listing appeal and pricing before applying.”

— Underwriting perspective

“Business-purpose STR loans let borrowers use entities and asset-based criteria, reducing reliance on W-2s or personal tax returns.”

— Investor takeaway

Real-Talk Pitfalls (and Fixes)

Overestimating occupancy. Seasonality and competition can lower bookings. Use conservative comps and add a reserve buffer.

Ignoring local regulations/HOA rules. Some areas restrict STRs or require permits. Verify legality before committing.

Insufficient reserves. Vacancies, repairs, or rate changes happen. Some programs require months of reserves—plan accordingly.

Unpermitted improvements. Non-permitted conversions can derail underwriting. Confirm permits and documentation.

Frequently Asked Questions

Conclusion: Launch Your STR Portfolio with Confidence

Short term rental loans exist for the pace and realities of hosting—faster closings, income-based approvals, and LLC-friendly structures. With clear projections, organized documents, and a realistic DSCR, you can move quickly on high-potential properties.

If you’re comparing options, start with conservative comps and confirm local regulations. When the numbers pencil, an STR-specific program or vacation rental financing route can help you scale from first purchase to a resilient, multi-door portfolio.

Disclaimer: This article provides general information on short term rental loans and is not personalized financial, legal, or investment advice. Loan terms, rates, and eligibility vary by lender and situation. Always consult a qualified professional before making decisions. Information current as of October 2025; subject to change.