Imagine owning your dream home in half the time it takes to build a traditional house, saving thousands of dollars, and still getting a high-quality, customizable design that rivals any site-built home. Sounds too good to be true? Welcome to the world of modular construction—a game-changer for first-time buyers and savvy homeowners in 2025. A modular home is a prefabricated house built in sections, or “modules,” inside a climate-controlled factory, then transported and assembled on a permanent foundation on your lot. Unlike manufactured or mobile homes, modular homes follow the same local building codes as traditional houses, ensuring safety, sturdiness, and value. If you’re feeling overwhelmed by skyrocketing construction costs or endless build timelines, factory-built housing might be the solution you’ve been searching for. But how do these builds differ from other options? And how do you finance one in today’s market?

In this guide, we’ll break down everything you need to know about modular homes: what they are, their advantages and drawbacks, how they compare to other housing options, and expert financing tips to make your homeownership dreams a reality. For the complete picture on loans — including financing options, requirements, and lender strategies — check out our modular home loan guide. Whether you’re a first-time buyer or just curious about modern housing trends, read on to discover why these homes are the smart choice for 2025.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- What Is a Modular Home?

- Modular vs. Manufactured vs. Mobile Homes

- Pros and Cons of Prefab Homes in 2025

- 5 Common Myths About Prefab Homes—Debunked

- Financing Your Modular Home in 2025

- Real-Life Success: Case Studies

- Is a Modular Build Right for You?

- FAQs About Modular Homes

- Conclusion

What Is a Modular Home?

A modular home is a prefabricated house built in sections, or “modules,” inside a climate-controlled factory. These modules are then transported to your chosen building site, where they’re assembled on a permanent foundation, like a concrete slab or basement. Unlike traditional “stick-built” homes constructed entirely on-site, these homes combine the precision of factory production with the durability of a permanent structure.

What sets these homes apart is that they’re built to the same local and state building codes as traditional builds. This ensures they’re just as safe, sturdy, and valuable as site-built houses. Picture a high-quality puzzle: each module is crafted with precision in the factory, then seamlessly pieced together on-site to create a beautiful, code-compliant home. Sizes range from 800 sq ft starter homes to 3,000+ luxury builds, all tweakable for your vibe, whether you’re dreaming of a modern farmhouse or a sleek urban retreat. And because they’re built indoors, weather delays are far less likely, often shaving months off the construction timeline.

“Factory precision means fewer mistakes and faster builds, giving you a home that’s both high-quality and move-in ready sooner,” says Jane Doe, a 20-year modular home builder.

Modular vs. Manufactured vs. Mobile Homes: What’s the Difference?

It’s easy to confuse factory-built options with manufactured or mobile homes since each is built indoors. However, the differences are significant, impacting quality, financing, and long-term value. While all factory-built, modular builds stand out for their permanent foundations and local code compliance, unlike the chassis-based manufactured/mobile options that often depreciate. Here’s a clear breakdown:

| Feature | Modular Home | Manufactured Home | Mobile Home |

|---|---|---|---|

| Construction | Factory-built, assembled on-site | Factory-built, movable | Older manufactured homes |

| Foundation | Permanent | Steel chassis | Steel chassis |

| Building Codes | Local/state | HUD Code | HUD Code (pre-1976) |

| Financing | Traditional mortgages | Often chattel or specialized programs | Often chattel or specialized programs |

Built-to-code differences drive lending and long-term value. To summarize, modular homes are closer to traditional homes in quality and value, while manufactured homes are more affordable but less customizable and durable. Understanding these distinctions is crucial when choosing the right housing option for your needs.

Quick Quiz: Is a Modular Home Right for You?

Is a Modular Home Right for You?

Answer 3 quick questions to get personalized insights.

What’s your budget for a new home?

How soon do you want to move in?

How important is customizing your home’s design?

Interactive quiz not available. Visit our affordability calculator to explore modular home options.

Pros and Cons of Prefab Homes in 2025

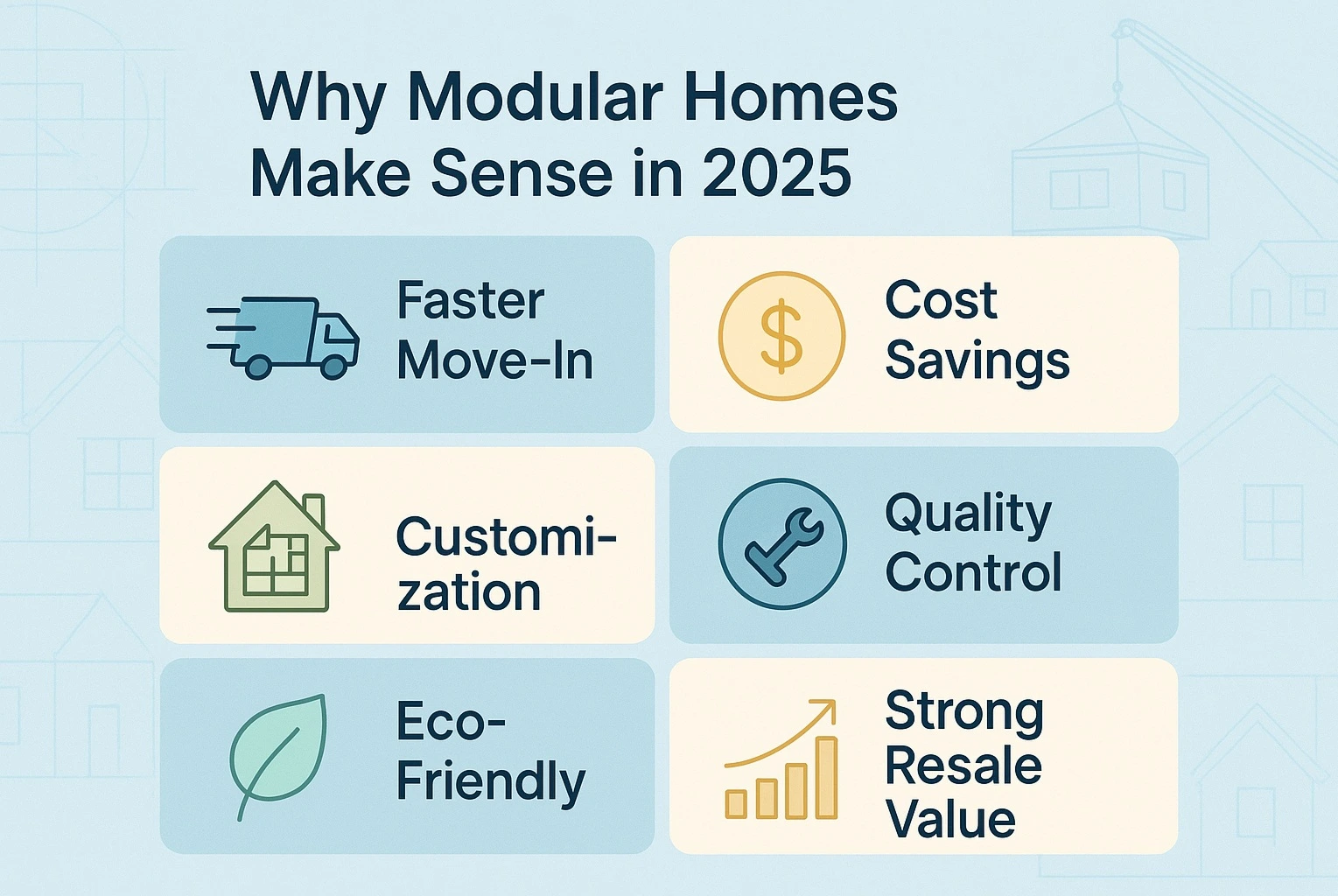

Prefab homes are surging in popularity, and it’s no surprise why. They offer a unique blend of affordability, efficiency, and flexibility that’s perfect for today’s homebuyers. In 2025, prefab builds are also benefiting from market trends like rising interest rates (prompting buyers to seek affordable options) and green financing incentives for eco-friendly designs. Speedy construction—often about 3–5 months—can reduce weather delays, while bulk material purchases may lower costs by around 10–15%. From open-concept layouts to energy-efficient upgrades, these builds offer diverse design options, with factories ensuring rigorous inspections for consistent quality. Looking ahead, 2025 trends like 3D-printed modules and smart integrations may amplify these perks, using sustainable materials such as bamboo framing and solar panels to help lower your carbon footprint and utility bills.

That said, challenges persist. You’ll need to own or buy land, which can be a significant upfront expense, especially in urban areas—site preparation (grading, utilities, foundation) adds to the budget. While these homes often qualify for traditional mortgages, some lenders are less familiar with them, requiring you to shop around for experienced ones. Moving modules from the factory to your site can cost roughly $5,000–$20,000, depending on distance and logistics, and not all contractors specialize in modular construction, so finding a reputable builder can be challenging in some areas. Some municipalities have strict zoning rules about where prefabricated homes can be built, and though fading, a stigma associating them with lower-quality mobile homes could affect perceptions (but not actual value). Actual costs depend on site work, transport distance, finishes, and local labor.

5 Common Myths About Prefab Homes—Debunked

Despite their rise, misconceptions linger. Myth 1: They’re just fancy trailers. Fact: Built to local codes on permanent foundations, they can appreciate like site-built homes and offer comparable durability, with reinforced frames that often make them sturdier for transport and weather events. Myth 2: Not customizable. Fact: You can tweak floor plans, add modern fixtures, or even work with architects for unique designs—from cozy cottages to multi-story retreats—making them as flexible as traditional builds. Myth 3: Hard to finance. Fact: They often qualify for standard mortgages like FHA or USDA via construction-to-permanent loans for factory-built homes; just shop lenders familiar with this process. Myth 4: Poor in disasters. Fact: Engineered to local seismic and storm codes, plus factory testing, they hold up well—sometimes better than site-built due to precise construction. Myth 5: Not eco-friendly. Fact: Many incorporate energy-saving features like advanced insulation and solar-ready wiring, which can help cut utility costs and reduce waste compared to on-site builds. This clarity helps you decide confidently.

Financing Your Modular Home in 2025

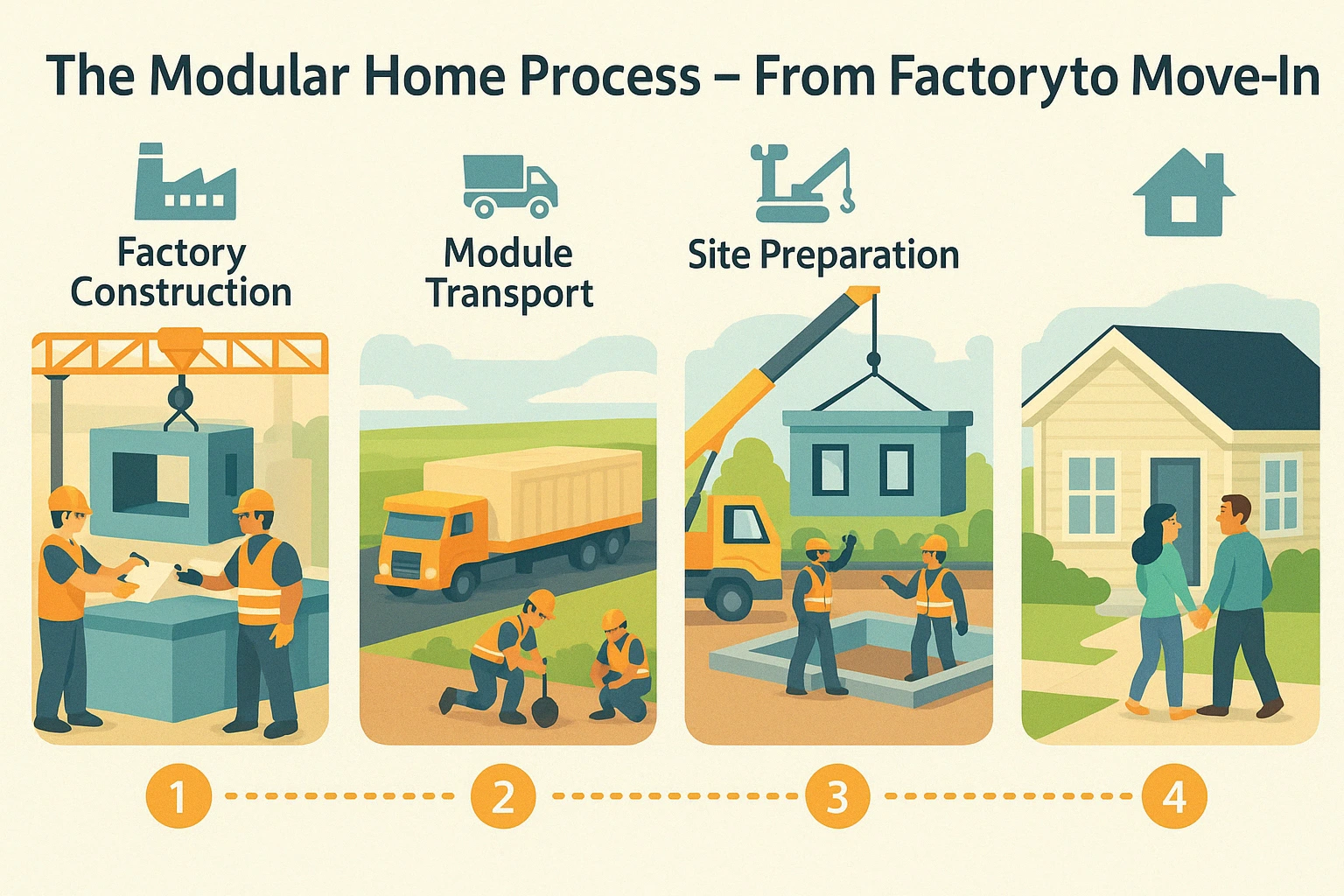

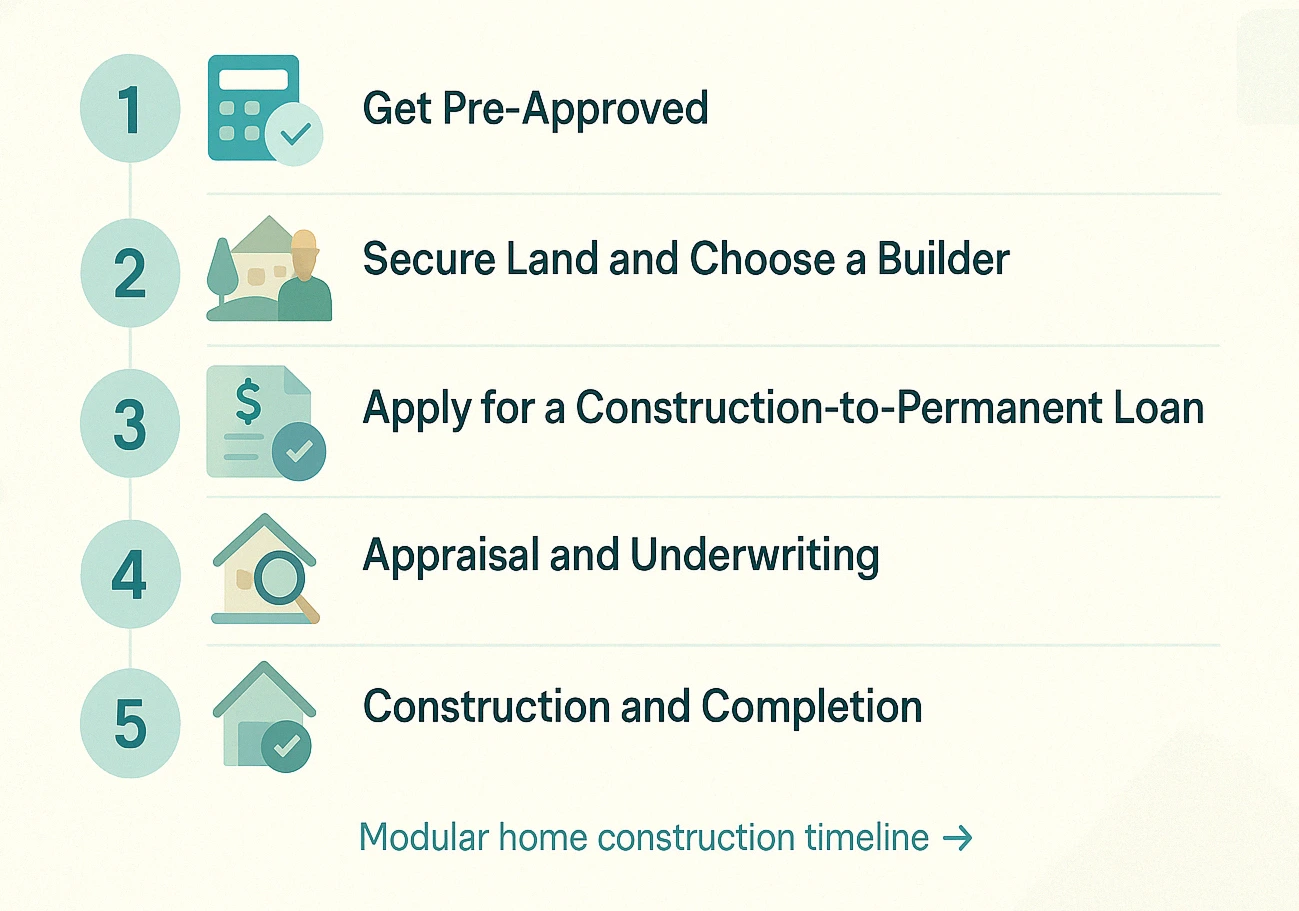

Financing a prefab home is similar to financing a traditional home, but there are a few unique considerations. Most buyers use a construction-to-permanent loan, which covers the building process and converts to a standard mortgage once the home is complete. Lenders use an as-completed appraisal (land + finished home), and land equity can offset the down payment. Here’s a step-by-step guide to securing financing:

Step 1: Get Pre-Approved

Before shopping, get pre-approved by a lender. This shows you what you can afford and strengthens your offer. You’ll typically need a credit score of 620 or higher for many loans, though FHA loans may accept scores as low as 500 with a larger down payment. Use our free mortgage calculator to estimate monthly payments.

Step 2: Secure Land and Choose a Builder

You’ll need land for your build, either purchased outright or financed with the loan. Land equity can count toward your down payment, reducing cash needed upfront. Choose a reputable builder experienced in modular construction to help ensure a smooth assembly process.

Step 3: Apply for a Construction-to-Permanent Loan

This loan can fund the factory build, transportation, site preparation, and assembly. Funds are released in stages (called “draws”) as construction progresses. Once the home is finished and inspected, the loan converts to a permanent mortgage, typically a 15- or 30-year term.

Step 4: Appraisal and Underwriting

The lender will appraise the completed home based on your plans, the land’s value, and local market trends. Provide detailed documentation, including builder contracts, module specifications, and permits, to streamline underwriting.

Step 5: Construction and Completion

Construction commonly takes a few months. The builder coordinates module delivery, assembly, and finishing touches like plumbing, electrical, and landscaping. After a final inspection, you close on the permanent mortgage and move in.

Types of Modular Home Loans

Options include construction-to-permanent loans (popular for a single closing and down payments that may range from about 5–20%), FHA loans (as little as 3.5% down with flexible credit requirements but added mortgage insurance), VA loans (0% down for eligible veterans, no private mortgage insurance), and USDA loans (0% down for qualifying rural areas). Visit HUD.gov to learn more about FHA and other loan programs.

Financing Tips

Compare rates from multiple lenders, especially those familiar with modular construction, and try to boost your credit score above 720 to secure lower interest rates. If you own land, its equity can reduce your down payment, and explore green incentives—some lenders offer rebates for energy-efficient builds in 2025. A mortgage broker experienced with factory-built homes can help navigate lender requirements.

“Financing is easier than ever in 2025, with more lenders understanding modular homes’ value,” notes John Smith, a mortgage expert.

Real-Life Success: Case Studies

Take Sarah, a single mother in Texas who dreamed of owning a home but couldn’t afford traditional construction. In 2025, she used a USDA loan with 0% down to finance a 1,200-square-foot prefab home. Her land equity covered the down payment, and the home was ready in about four months. “The energy-efficient features save me on utilities, and I love the open floor plan we customized,” she says. Sarah’s story shows how factory-built housing and smart financing can make homeownership accessible.

— Sarah, Texas Homeowner

The Thompsons, a young family in Oregon, wanted a spacious home without breaking the bank. In 2025, they financed a 2,000-square-foot factory-built home for $220,000, including $160,000 for the home, $40,000 for land preparation, and $20,000 for transport. They customized it with solar panels and hardwood floors, moving in after roughly 4.5 months. “The process was so smooth, and our utility bills are lower thanks to the eco-friendly design,” says Emily Thompson. Their story highlights the flexibility and savings of prefab builds.

— Emily Thompson, Oregon Homeowner

Is a Modular Build Right for You?

Wondering if a modular home fits your plans? Deciding if this route works for you depends on a few key factors. Whether it’s your quick timeline—needing to move in within months—or custom dreams for layout and features, these homes offer speed and flexibility to match your vision. Just factor in location (are factory-built homes allowed? Check zoning laws early) and financing (can you qualify for a mortgage? Pre-approval clarifies your options). Before you fall in love with a plan, call your local planning office for a quick zoning check so you know what’s allowed on your lot. If you value affordability, speed, and quality, this could be your perfect match. To explore further, tour model homes, connect with local manufacturers, or use our free mortgage calculator to estimate payments. Pro tip: Use 3D tools from builders like Dvele for virtual tours. Want to visualize your dream home? Some manufacturers offer 3D design tools to preview floor plans—ask your builder!

FAQs About Modular Homes

Conclusion: Your Path to Modular Homeownership

Prefab homes are reshaping housing in 2025, offering a budget-friendly, high-quality alternative to traditional construction. With faster build times, potential cost savings, and thoughtful customization options, they’re ideal for first-time buyers and anyone seeking a modern, sustainable home. From factory floors to your forever home, modulars aren’t just housing—they’re a smarter path in today’s market. By understanding the pros, cons, and financing options, you can confidently decide if a prefab home is right for you.

Ready to take the next step? Get pre-approved, explore designs, or calculate your affordability to find your perfect fit. Your dream home is closer than you think! We’ll keep this guide updated with the latest rates, trends, and codes—check back for 2025 insights.

Disclaimer: This article is for general information only and isn’t financial, legal, tax, engineering, or building-code advice. Codes, lender guidelines, costs, timelines, and eligibility vary by location and over time. Always confirm requirements with your local building department, a licensed builder, and a qualified lender before you act.