Uncover the fine print of modular home loans before hidden fees, balloon clauses, or appraisal rules catch you off guard. You’ve found your land and a plan that fits. Then the financing starts and the questions pile up. Unexpected costs, appraisal gaps, and fine print can derail a solid project. This guide shows you how to stay in control.

This guide focuses on avoiding pitfalls, but modular home financing works best with a full plan. For the complete picture (loan options, timelines, and step-by-step budgeting), see our modular home loans guide — the most detailed resource available and a clear comparison of common modular home mortgage options.

At a glance: Many buyers use construction-to-permanent financing. Funds are released in draws during the build and the loan converts to a regular mortgage at completion. Lenders may expect a permanent foundation, a licensed builder, and clear factory specs. You’ll likely see more inspections and paperwork than a standard mortgage, and the appraisal should rely on modular comps wherever possible.

Modular Loan Readiness Check

It takes about 3 minutes. As you choose options below, your score updates automatically with targeted next steps.

This post contains affiliate links. If you buy through our links, we may earn a commission at no extra cost to you. Learn more.

Table of Contents

- What Are Modular Home Loans?

- How Modular Financing Is Structured (And What Costs Add Up)

- Required Documents & Timeline (At a Glance)

- Appraisal Traps & Dangerous Loan Terms to Avoid

- Your 7-Step Checklist to Avoid Modular Loan Disasters

- How to Compare Modular Loan Offers

- FAQ: Modular Financing

- Final Thoughts: Transparency = Peace of Mind

What Are Modular Home Loans?

Modular home loans are mortgages designed to finance factory-built homes that are transported to a property and assembled on a permanent foundation. These homes follow the same local building codes as site-built homes, but many banks still treat modular financing as riskier, which can lead to confusing terms, extra costs, or delays. Your best defense is clarity — know the loan type, fees, and appraisal plan before you apply.

If you’re looking to secure financing, understanding what lenders don’t always disclose can save you money and protect your investment. For a broader overview of buying and financing, learn more from Modular Homes.

“Modular homes can be harder to finance than traditional homes, not because they’re less valuable, but because banks have stricter, sometimes outdated, criteria.”

How Modular Financing Is Structured (And What Costs Add Up)

Most modular home loans use a construction-to-permanent loan (construction-to-perm) that bundles land and home costs. It can simplify closing, but trade-offs include a typical 15–30% down payment if you don’t already own land, strict draw schedules tied to inspections, and potential funding pauses if delivery or assembly slips. Programs, fees, and draw rules vary by lender and state — ask for a written, itemized estimate before you commit.

Hidden Fees to Budget For

| Fee Type | Typical Range |

|---|---|

| Draw/Disbursement Fee | $100–$500 (per draw) |

| Loan Conversion Fee | $300–$1,000 |

| Specialty Appraisal | $400–$1,200 |

| Site Inspection Fees | $150–$600 (each stage) |

| Land Survey | $500–$2,000 |

Before you budget, request a full list of one-time and recurring fees (draws, re-inspections, third-party costs). Model payments with our free mortgage calculator.

Required Documents & Timeline (At a Glance)

| Stage | What Lenders Usually Ask For | Why It Matters |

|---|---|---|

| Pre-Approval | Credit pull, income docs (W-2/1099), land status, budget | Sets realistic limits and flags down-payment gaps early |

| Underwriting | Builder contract, draw schedule, factory specs, plans | Aligns inspections, release timing, and appraisal approach |

| Appraisal | Modular comps, site details, energy ratings | Supports valuation and prevents mix-ups with manufactured homes |

| Draws | Milestone inspections, change-order approvals | Ensures funds match build progress without cash crunches |

| Conversion | Final inspection, cert of occupancy, conversion docs | Wraps construction loan into your permanent mortgage |

Appraisal Traps & Dangerous Loan Terms to Avoid

A modular home appraisal often follows stricter rules and can get tripped up by confusion with manufactured homes. Appraisers sometimes use manufactured homes as comps, which can undervalue your build. In areas with few modular sales, finding solid comps takes longer because both the structure and the land are reviewed together. Ask your lender to use a modular-experienced appraiser and bring factory specs to the table.

Balloon clauses can require a large payoff in year 5–7. If you can’t refinance, that’s a problem. Always ask if a balloon applies and what it means for your exit plan.

Modular vs Traditional: Key Differences

| Feature | Modular Home Loan | Traditional Mortgage |

|---|---|---|

| Appraisal Rules | Modular-only comps preferred | Flexible, site-built comps |

| Loan Type | Construction-to-perm common | Standard 15/30 year |

| Draw Schedule | Multi-stage inspections | Full amount at closing |

| Balloon Clause Risk | Possible depending on lender | Rare |

| Fees | More frequent and variable | Lower and more predictable |

| Rate Flexibility | Often limited | Highly competitive |

Your 7-Step Checklist to Avoid Modular Loan Disasters

- Confirm whether land and home must be bundled for financing

- Ask directly about balloon clauses or ARM traps

- Request a full list of fees: draw, inspections, surveys, appraisals

- Ask who will perform the appraisal and what comps they’ll use

- Use lenders that specialize in modular financing

- Ask for a sample loan estimate in writing

- Compare at least three lenders, including a credit union

To ensure you’re financially prepared, try our free home affordability calculator to see what loan size fits your budget.

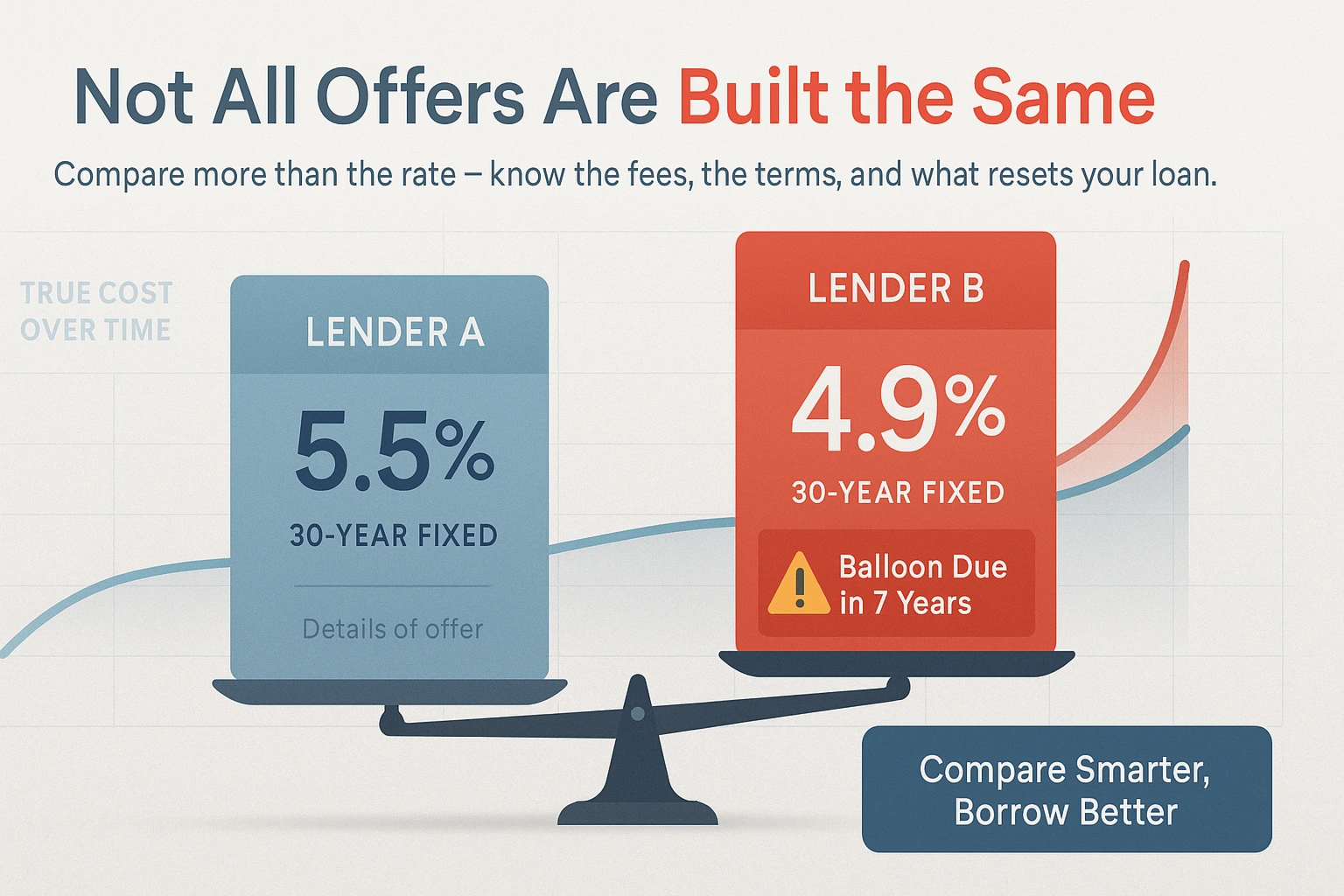

How to Compare Modular Loan Offers

The example below is for illustration only; rates, fees, and terms can vary by lender and borrower profile. Use it to see how small differences add up over time.

| Feature | Lender A | Lender B |

|---|---|---|

| Interest Rate | 6.85% | 7.15% |

| Down Payment | 20% | 15% |

| Appraisal Type | In-house (general) | Modular-specific expert |

| Balloon Clause? | No | Yes (due in 7 years) |

| Construction-to-Perm Fee | $650 | $1,250 |

| Total 5-Year Cost | $78,200 | $92,100 (+balloon risk) |

Mini-guide: Rate locks for construction loans often last 60–180 days and may include a one-time “float-down.” Time the lock to your delivery calendar and inspection cadence, not just closing day. For draws, ask about per-inspection fees, re-inspection costs for weather delays, and how change orders affect release timing.

Frequently Asked Questions

Final Thoughts: Transparency = Peace of Mind

Modular financing can be a powerful path to affordable homeownership—when you know what to ask, what to watch for, and who to work with. By understanding what banks don’t always disclose, you’ll be ready to compare offers clearly and choose the structure that fits your budget and timeline.

Ready to take the next step? Gather the details, consult trusted experts, and don’t hesitate to negotiate or walk away if something doesn’t feel right. If you found this guide helpful, share it with others exploring modular financing, or reach out for more tips on making your homeownership journey smooth and stress-free!

You deserve a home loan that works for you, not against you.

This guide is educational and not legal, tax, or financial advice. Programs, rates, fees, and appraisal practices can change and vary by lender and location. Always request written estimates and consult a licensed mortgage professional. SmartHouseFinance is not a lender.